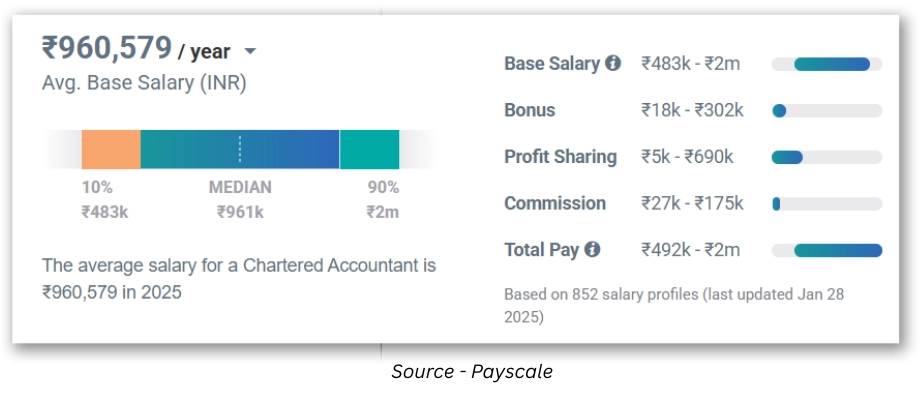

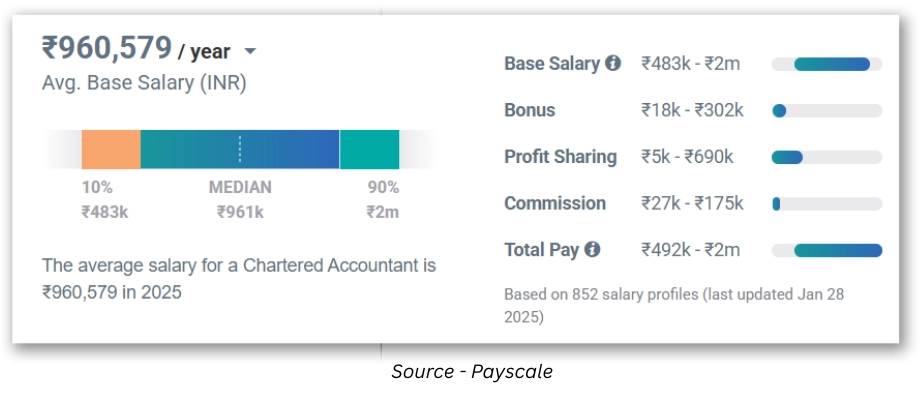

Chartered Accountant (CA) salary in India is once again hitting headlines after ICAI’s 2025 placement season recorded a domestic peak of ₹ 36 LPA. Whether you’re a fresher hunting for your first offer or an experienced professional benchmarking your next raise, this guide breaks down every rupee – from Big-4 packages to Dubai tax-free deals and tells the average salary of a Chartered accountant(CA) in India in 2025.

Key Stats: According to the latest ICAI placement reports, the highest domestic salary offered to a CA in 2025 was ₹36 LPA, while the average salary ranges between ₹11-15 LPA. Learning Routes

A Chartered Accountant (CA) is a certified financial professional responsible for managing, auditing, and analyzing financial records of individuals or organizations.In India, CAs are regulated by the Institute of Chartered Accountants of India (ICAI) under the Chartered Accountants Act, 1949. They handle key areas like accounting, taxation, auditing, and financial management. CAs ensure businesses follow all legal and tax regulations accurately.

They also offer expert advice on budgeting, investments, and cost control. To become a CA, one must clear three exam levels: Foundation, Intermediate, and Final (along with a 3-year articleship training). CAs work in diverse fields such as corporate firms, banks, government, or independent practice. They play a crucial role in ensuring financial transparency and integrity within the economy.

| Experience Level | Annual Salary Range (LPA) | Monthly Salary (INR) |

|---|---|---|

| Freshers (0–1 years) | ₹6–9 LPA | ₹50,000–75,000 |

| Intermediate (2–4 years) | ₹11–15 LPA | ₹90,000–1,25,000 |

| Experienced (5+ years) | ₹15–25 LPA | ₹1,25,000–2,00,000 |

| Senior Level (10+ years) | ₹25–50 LPA | ₹2,00,000–4,00,000 |

| Highest Packages | ₹50–75 LPA | ₹4,00,000–6,00,000 |

A chartered accountant’s journey begins with a promising earnings potential. Starting salaries for CA freshers range from ₹6-9 lakhs per year, with a monthly take-home pay of ₹55,000–75,000. Learning Routes However, several factors can significantly enhance these initial packages:

Rank holders and first-attempt clearers often receive premium packages from top firms and MNCs.

City-wise CA salaries in India vary based on living costs, job demand, and company presence.

Cities like Mumbai, Delhi, and Bengaluru offer the highest packages, often ranging from ₹10–25 LPA for mid-level professionals due to strong corporate and financial hubs.

In contrast, Tier-2 cities like Jaipur or Indore may offer slightly lower pay but better work-life balance and lower expenses.

Overall, metro cities provide more opportunities and faster career growth for CAs.

| City | Fresher Monthly | 10+ Years Experience |

|---|---|---|

| Mumbai | ₹70,000–90,000 | ₹3.5L–6L |

| Delhi NCR | ₹65,000–85,000 | ₹3L–5L |

| Bangalore | ₹60,000–80,000 | ₹2.8L–4.5L |

| Hyderabad | ₹55,000–75,000 | ₹2.5L–4L |

| Chennai | ₹55,000–75,000 | ₹2.5L–4L |

The Big 4 accounting firms: Deloitte, PwC, EY, and KPMG, are top destinations for chartered accountants in India, known for their global exposure and structured career growth.

Fresh CAs at these firms typically earn between ₹8–12 LPA, with salaries increasing rapidly with experience and performance. They offer perks like international assignments, bonuses, and professional training, making them highly competitive employers.

Working at a Big 4 firm also provides a strong foundation in audit, taxation, consulting, and financial advisory, opening doors to senior roles in major corporations.

|

The banking sector has become one of the most lucrative fields for Chartered Accountants in India.

In 2025, CAs working in banks can expect salaries ranging from ₹6–45 LPA, depending on the role and bank type.

While private and public sector banks hire CAs for finance, audit, and risk roles, institutions like the RBI offer some of the highest packages.

This sector also provides strong job stability, growth prospects, and opportunities for leadership positions.

| Bank Type | Salary Range (LPA) |

|---|---|

| Reserve Bank of India | ₹18 – 25 LPA |

| Private Banks (HDFC, ICICI, Kotak) | ₹6 – 9 LPA (Freshers) |

| Public Sector Banks | ₹8 – 18 LPA |

| Senior Banking Roles | ₹25 – 45 LPA |

Industry-wise CA salary analysis shows that pay packages vary significantly across sectors.

CAs in banking, finance, and consulting earn the highest, often between ₹12–40 LPA, due to high-value financial operations.

Industries like manufacturing, IT, and real estate offer moderate but stable salaries.

Overall, the compensation depends on the industry’s financial scale, complexity, and demand for analytical expertise.

Indian Chartered Accountants have excellent international career prospects, especially in finance hubs like Dubai.

Freshers can earn between AED 8,000–12,000 per month (₹1.8–2.7 lakh), along with a tax-free income.

They also enjoy additional benefits such as housing, travel, and health allowances.

Dubai’s growing financial sector and global exposure make it a top destination for ambitious CAs.

The career progression for Chartered Accountants is both structured and rewarding, with salaries rising sharply with experience.

Freshers usually start at ₹6–9 LPA, and within 5–8 years, earnings can grow to ₹15–25 LPA.

Senior professionals with over a decade of experience often earn ₹25–70 LPA or more, especially in leadership roles.

Continuous learning, specialization, and industry exposure play key roles in this salary growth.

| Years of Experience | Expected Salary Range (LPA) |

|---|---|

| 0 – 1 Years | ₹6 – 9 LPA |

| 1 – 3 Years | ₹7 – 12 LPA |

| 3 – 5 Years | ₹12 – 18 LPA |

| 5 – 8 Years | ₹15 – 25 LPA |

| 8+ Years | ₹25 – 70 LPA |

CAs hold some of the most prestigious roles in the finance domain, each offering impressive pay scales.

Top positions like Chief Financial Officer (CFO) command salaries between ₹50 LPA – ₹1 crore+, reflecting their strategic importance.

Roles such as Finance Controller and Finance Manager earn around ₹10–35 LPA, while Financial Analysts start at ₹6–10 LPA.

These profiles highlight the diverse and high-paying career paths available to skilled Chartered Accountants.

Certain specialized skills can greatly enhance a CA’s earning potential in India.

Expertise in Financial Modeling, IFRS/IND AS, and International Taxation can lead to salary hikes of up to 25–30%.

Proficiency in Data Analytics, Automation, and SAP/ERP systems makes CAs more valuable in tech-driven finance roles.

These skills not only boost salaries but also open doors to global and leadership opportunities.

Chartered Accountants (CAs) are among the highest-paid professionals in India, thanks to their strong financial and analytical expertise.

Compared to doctors, engineers, and lawyers, CAs enjoy faster salary growth and higher earning potential.

Their skills in audit, taxation, and financial strategy make them vital across all industries.

With experience, many CAs advance to senior leadership roles, earning ₹25 LPA to ₹1 crore+ annually.

Chartered Accountants consistently rank among India’s highest-paid professionals:

| Profession | Starting Salary (LPA) | 10+ Years Experience (LPA) |

|---|---|---|

| CA | ₹6 – 9 LPA | ₹25 – 50 LPA |

| Doctor | ₹5 – 8 LPA | ₹15 – 30 LPA |

| Lawyer | ₹4 – 7 LPA | ₹12 – 25 LPA |

| Engineer | ₹3 – 6 LPA | ₹15 – 35 LPA |

The future of CA salaries in India is highly promising, driven by digital transformation and evolving financial regulations.

With GST, IFRS, and ESG reporting creating new opportunities, demand for skilled CAs is set to surge.

The growing startup ecosystem and global expansion of Indian firms are further boosting pay scales.

By 2030, freshers may earn ₹8–12 LPA, while experienced CAs could see 15–20% annual salary growth, especially in specialized roles.

Chartered Accountancy still delivers one of India’s best salary-to-investment ratios: ₹ 8–9 LPA median today, ₹ 25–50 LPA by year 10 for those who treat learning as continuous, not terminal. Rank, Big-4 articleship, and data/ESG add-ons remain the fastest levers to beat the average. Automation is trimming low-end compliance fees, so the future premium lies at the intersection of audit, analytics, and sustainability reporting. Pick cities and roles for post-rent surplus, not headline CTC; a ₹ 9 L package in Pune often leaves more cash than ₹ 12 L in Mumbai. Stay re-skilled every three years, and the CA tag will keep compounding faster than most MBA price tags without the ₹ 25 L tuition.

I’m a contributor at Finanjo, where I write about personal finance, banking, and everyday money topics in a clear and practical way. I simplify complex finance jargon into easy explanations and real-life insights, covering everything from bank accounts and deposits to government schemes and smart money decisions so readers can understand finance without the confusion.

Chartered Accountant (CA) salary in India is once again hitting headlines after ICAI’s 2025 placement season recorded a domestic peak of ₹ 36 LPA. Whether you’re a fresher hunting for your first offer or an experienced professional benchmarking your next raise, this guide breaks down every rupee – from Big-4 packages to Dubai tax-free deals and tells the average salary of a Chartered accountant(CA) in India in 2025.

Key Stats: According to the latest ICAI placement reports, the highest domestic salary offered to a CA in 2025 was ₹36 LPA, while the average salary ranges between ₹11-15 LPA. Learning Routes

A Chartered Accountant (CA) is a certified financial professional responsible for managing, auditing, and analyzing financial records of individuals or organizations.In India, CAs are regulated by the Institute of Chartered Accountants of India (ICAI) under the Chartered Accountants Act, 1949. They handle key areas like accounting, taxation, auditing, and financial management. CAs ensure businesses follow all legal and tax regulations accurately.

They also offer expert advice on budgeting, investments, and cost control. To become a CA, one must clear three exam levels: Foundation, Intermediate, and Final (along with a 3-year articleship training). CAs work in diverse fields such as corporate firms, banks, government, or independent practice. They play a crucial role in ensuring financial transparency and integrity within the economy.

| Experience Level | Annual Salary Range (LPA) | Monthly Salary (INR) |

|---|---|---|

| Freshers (0–1 years) | ₹6–9 LPA | ₹50,000–75,000 |

| Intermediate (2–4 years) | ₹11–15 LPA | ₹90,000–1,25,000 |

| Experienced (5+ years) | ₹15–25 LPA | ₹1,25,000–2,00,000 |

| Senior Level (10+ years) | ₹25–50 LPA | ₹2,00,000–4,00,000 |

| Highest Packages | ₹50–75 LPA | ₹4,00,000–6,00,000 |

A chartered accountant’s journey begins with a promising earnings potential. Starting salaries for CA freshers range from ₹6-9 lakhs per year, with a monthly take-home pay of ₹55,000–75,000. Learning Routes However, several factors can significantly enhance these initial packages:

Rank holders and first-attempt clearers often receive premium packages from top firms and MNCs.

City-wise CA salaries in India vary based on living costs, job demand, and company presence.

Cities like Mumbai, Delhi, and Bengaluru offer the highest packages, often ranging from ₹10–25 LPA for mid-level professionals due to strong corporate and financial hubs.

In contrast, Tier-2 cities like Jaipur or Indore may offer slightly lower pay but better work-life balance and lower expenses.

Overall, metro cities provide more opportunities and faster career growth for CAs.

| City | Fresher Monthly | 10+ Years Experience |

|---|---|---|

| Mumbai | ₹70,000–90,000 | ₹3.5L–6L |

| Delhi NCR | ₹65,000–85,000 | ₹3L–5L |

| Bangalore | ₹60,000–80,000 | ₹2.8L–4.5L |

| Hyderabad | ₹55,000–75,000 | ₹2.5L–4L |

| Chennai | ₹55,000–75,000 | ₹2.5L–4L |

The Big 4 accounting firms: Deloitte, PwC, EY, and KPMG, are top destinations for chartered accountants in India, known for their global exposure and structured career growth.

Fresh CAs at these firms typically earn between ₹8–12 LPA, with salaries increasing rapidly with experience and performance. They offer perks like international assignments, bonuses, and professional training, making them highly competitive employers.

Working at a Big 4 firm also provides a strong foundation in audit, taxation, consulting, and financial advisory, opening doors to senior roles in major corporations.

|

The banking sector has become one of the most lucrative fields for Chartered Accountants in India.

In 2025, CAs working in banks can expect salaries ranging from ₹6–45 LPA, depending on the role and bank type.

While private and public sector banks hire CAs for finance, audit, and risk roles, institutions like the RBI offer some of the highest packages.

This sector also provides strong job stability, growth prospects, and opportunities for leadership positions.

| Bank Type | Salary Range (LPA) |

|---|---|

| Reserve Bank of India | ₹18 – 25 LPA |

| Private Banks (HDFC, ICICI, Kotak) | ₹6 – 9 LPA (Freshers) |

| Public Sector Banks | ₹8 – 18 LPA |

| Senior Banking Roles | ₹25 – 45 LPA |

Industry-wise CA salary analysis shows that pay packages vary significantly across sectors.

CAs in banking, finance, and consulting earn the highest, often between ₹12–40 LPA, due to high-value financial operations.

Industries like manufacturing, IT, and real estate offer moderate but stable salaries.

Overall, the compensation depends on the industry’s financial scale, complexity, and demand for analytical expertise.

Indian Chartered Accountants have excellent international career prospects, especially in finance hubs like Dubai.

Freshers can earn between AED 8,000–12,000 per month (₹1.8–2.7 lakh), along with a tax-free income.

They also enjoy additional benefits such as housing, travel, and health allowances.

Dubai’s growing financial sector and global exposure make it a top destination for ambitious CAs.

The career progression for Chartered Accountants is both structured and rewarding, with salaries rising sharply with experience.

Freshers usually start at ₹6–9 LPA, and within 5–8 years, earnings can grow to ₹15–25 LPA.

Senior professionals with over a decade of experience often earn ₹25–70 LPA or more, especially in leadership roles.

Continuous learning, specialization, and industry exposure play key roles in this salary growth.

| Years of Experience | Expected Salary Range (LPA) |

|---|---|

| 0 – 1 Years | ₹6 – 9 LPA |

| 1 – 3 Years | ₹7 – 12 LPA |

| 3 – 5 Years | ₹12 – 18 LPA |

| 5 – 8 Years | ₹15 – 25 LPA |

| 8+ Years | ₹25 – 70 LPA |

CAs hold some of the most prestigious roles in the finance domain, each offering impressive pay scales.

Top positions like Chief Financial Officer (CFO) command salaries between ₹50 LPA – ₹1 crore+, reflecting their strategic importance.

Roles such as Finance Controller and Finance Manager earn around ₹10–35 LPA, while Financial Analysts start at ₹6–10 LPA.

These profiles highlight the diverse and high-paying career paths available to skilled Chartered Accountants.

Certain specialized skills can greatly enhance a CA’s earning potential in India.

Expertise in Financial Modeling, IFRS/IND AS, and International Taxation can lead to salary hikes of up to 25–30%.

Proficiency in Data Analytics, Automation, and SAP/ERP systems makes CAs more valuable in tech-driven finance roles.

These skills not only boost salaries but also open doors to global and leadership opportunities.

Chartered Accountants (CAs) are among the highest-paid professionals in India, thanks to their strong financial and analytical expertise.

Compared to doctors, engineers, and lawyers, CAs enjoy faster salary growth and higher earning potential.

Their skills in audit, taxation, and financial strategy make them vital across all industries.

With experience, many CAs advance to senior leadership roles, earning ₹25 LPA to ₹1 crore+ annually.

Chartered Accountants consistently rank among India’s highest-paid professionals:

| Profession | Starting Salary (LPA) | 10+ Years Experience (LPA) |

|---|---|---|

| CA | ₹6 – 9 LPA | ₹25 – 50 LPA |

| Doctor | ₹5 – 8 LPA | ₹15 – 30 LPA |

| Lawyer | ₹4 – 7 LPA | ₹12 – 25 LPA |

| Engineer | ₹3 – 6 LPA | ₹15 – 35 LPA |

The future of CA salaries in India is highly promising, driven by digital transformation and evolving financial regulations.

With GST, IFRS, and ESG reporting creating new opportunities, demand for skilled CAs is set to surge.

The growing startup ecosystem and global expansion of Indian firms are further boosting pay scales.

By 2030, freshers may earn ₹8–12 LPA, while experienced CAs could see 15–20% annual salary growth, especially in specialized roles.

Chartered Accountancy still delivers one of India’s best salary-to-investment ratios: ₹ 8–9 LPA median today, ₹ 25–50 LPA by year 10 for those who treat learning as continuous, not terminal. Rank, Big-4 articleship, and data/ESG add-ons remain the fastest levers to beat the average. Automation is trimming low-end compliance fees, so the future premium lies at the intersection of audit, analytics, and sustainability reporting. Pick cities and roles for post-rent surplus, not headline CTC; a ₹ 9 L package in Pune often leaves more cash than ₹ 12 L in Mumbai. Stay re-skilled every three years, and the CA tag will keep compounding faster than most MBA price tags without the ₹ 25 L tuition.

I’m a contributor at Finanjo, where I write about personal finance, banking, and everyday money topics in a clear and practical way. I simplify complex finance jargon into easy explanations and real-life insights, covering everything from bank accounts and deposits to government schemes and smart money decisions so readers can understand finance without the confusion.