Ever opened your salary slip and felt completely lost? Your pay isn’t just a number it’s a mix of components, allowances, and deductions that decide your take-home salary. Understanding how your salary is structured can help you plan your finances smarter and know exactly where your money is going. Let’s unravel your paycheck and see what each component really means.

Think of your salary as the money your company gives you for showing up, working, stressing, replying to emails, and doing everything your job demands.

Whether you work in a government office, an MNC, a startup, a bank, or a local private firm your salary is the fixed amount you’re paid regularly, usually once a month, as part of your yearly package.

But here’s the catch:

That one neat number you see in the offer letter? It’s not just one thing.

Your salary is actually a combo pack of:

All these pieces together decide:

Now, when all these parts are arranged properly and given a structure, that’s what we call your salary structure.

So, what exactly is a Salary Structure?

A salary structure is basically the full breakup of your pay.

It shows how your total CTC is divided into basic salary, allowances, deductions, contributions, and so on.

This breakdown is usually created by the HR and payroll team.

They decide:

Even a small change in this structure…like increasing basic pay or changing an allowance can affect:

So, a salary structure isn’t just an HR formality.

It quietly decides how “rich” or “broke” you feel at the end of the month.

What actually makes up your salary?

When you get a job offer, they usually show you one big number as CTC and it looks very exciting. But when the first salary hits the account, it’s always less than what you imagined

That’s because your salary is not just one straight amount it’s made of different parts.

Here’s the basic breakup, in simple language:

It includes things like:

So if they say “CTC ₹6 lakh”, less than that will come to your account every month.

It includes:

No tax, PF or other deductions are removed yet. So this amount always looks bigger than what you actually receive.

This is the real amount you get in your bank every month.

Rough idea:

Take-home salary = Gross salary – (tax + PF + other deductions)

Whatever is left after all the cuts is your net salary, this is what you actually live on.

These are extra amounts your company gives for specific things, like:

Some of these can also help you save tax, if planned properly.

These are not always cash but extra benefits you get as an employee, for example:

They don’t always show up as “money in hand” but they do reduce your personal expenses.

This is the part that hurts a little the money that gets cut from your salary.

Common ones are:

Because of these cuts, your take-home becomes lower, but things like PF are actually forced savings for later.

This is the extra amount you can earn apart from your fixed salary.

It may come:

Not always guaranteed every month, but when it comes, mood automatically improves

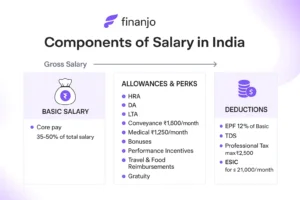

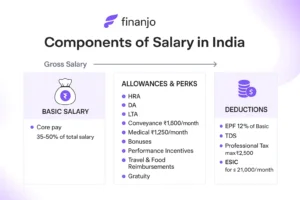

Think of this as the core of your pay.

It’s the main chunk that usually makes up 35–50% of your total salary.

How it’s decided? Well… a mix of things:

Most of the other parts of your salary like PF, HRA, bonuses are usually calculated as a percentage of basic.

Taxes:

100% of your basic is taxable. So if your basic is ₹40,000 per month, the whole ₹40k is considered for income tax.

Okay, so allowances are basically extra money your company gives on top of your basic pay. Not just for fun they’re to cover things like rent, travel, medical stuff, etc.

Non-monetary benefits and additional payments:

| Component | Description | Taxability / Notes |

|---|---|---|

| Overtime | Extra pay for work beyond normal hours | Fully taxable |

| Bonus | Fixed amount for completing a year or on festivals | Fully taxable |

| Performance Incentive (PLI) | Bonus for outstanding results | Fully taxable |

| Salary Arrears | Retroactive payment due to salary revisions | Fully taxable |

| Travel / Food Reimbursement | Business-related expenses reimbursed | Tax-exempt if actual expense incurred |

| Gratuity | Lump sum after 5+ years of service | Fully exempt if due to retirement / superannuation / termination |

Gratuity = (Last Drawn Salary × 15 × Years of Service) ÷ 26

Subtracted from gross salary to meet statutory requirements:

| Deduction | Description |

|---|---|

| Employee Provident Fund (EPF) | 12% of Basic + DA contributed by employee; matched by employer. Provides retirement savings. |

| Professional Tax (PT) | State-specific; max ₹2,500/year. |

| Tax Deducted at Source (TDS) | Portion of income tax deducted monthly. Rate usually 10%, adjusted at year-end. |

| Employees’ State Insurance (ESIC) | Applicable if gross salary ≤ ₹21,000/month in organizations with 10+ employees. Provides medical & social security benefits. |

Example:

Think: Gross = total cake, Net = your slice

Figuring out your take-home salary (the money that actually hits your bank account) can feel confusing at first but if you break it down step by step, it’s quite simple. Let’s walk through it.

Your gross salary is basically your total earnings before any deductions. You can calculate it like this:

Think of gross salary as all the money you’ve earned before the government and other contributions take their share.

Next, figure out how much of your income is taxable.

What counts as deductions?

Popular Sections for Tax Deductions:

| Section | Purpose | Limit |

|---|---|---|

| 80C | Investments like PF, PPF, ELSS | ₹1.5 lakh |

| 80TTA | Savings account interest | ₹10,000 |

| 80G | Donations to charity | 50% of donation |

| 80E | Education loan interest | No limit |

| 80EE | Home loan interest | ₹50,000/year |

| 80D | Medical insurance premium | ₹25,000 (self & family), ₹55,000 (self + parents), ₹80,000 (self + senior citizen parents) |

Once you know your taxable income, calculate income tax according to the current slabs.

| Income Range (₹) | Tax Rate |

|---|---|

| Up to 4,00,000 | Nil |

| 4,00,001 – 8,00,000 | 5% |

| 8,00,001 – 12,00,000 | 10% |

| 12,00,001 – 16,00,000 | 15% |

| 16,00,001 – 20,00,000 | 20% |

| 20,00,001 – 24,00,000 | 25% |

| Above 24,00,000 | 30% |

Finally, subtract all deductions from your gross salary to get your take-home pay:

Let’s assume your CTC (Cost to Company) is ₹12,00,000 per year.

Here’s what gets deducted from your salary:

| Deduction Type | Amount (₹) | Notes |

|---|---|---|

| Professional Tax | 2,500 | Example: Maharashtra state PT |

| Employee Provident Fund (EPF) | 21,600 | 12% of ₹15,000/month (EPF salary cap) |

| Employee Insurance | 4,000 | Annual deduction |

| Total Deductions | 28,100 |

Note: Employer also contributes ₹21,600 to your EPF. This is part of your CTC but does not come out of your salary.

Now, subtract your deductions from gross salary:

Summary:

This format makes it clear, readable, and easy to understand for anyone trying to figure out their salary.

Good Salary Structure

Basically: good for you, good for company, legal.

Think of it like a breakup of your salary. Shows basic pay, allowances, bonuses, perks, deductions. Basically, tells you what actually lands in your account.

Not really. Usually it’s 35–50%, depends on your company, role, city. So don’t panic if it’s less.

Mostly govt jobs. Part of the 7th Pay Commission pay matrix. Private jobs? Forget it.

CTC = Basic + HRA + Allowances + Bonus + PF + Gratuity + Insurance + Perks.

Your in-hand is just one part of this big number.

It’s a tool online. You put CTC, basic, HRA, city, investments. It tells you your take-home salary, tax, deductions. Super handy.

Rule says: Basic + DA ≥ 50% of CTC.

Good thing: PF & gratuity go up. Slight downside: take-home may drop a bit.

HRA, DA, Conveyance, Medical, LTA, Special Allowance.

Some can save you tax if used smartly.

Nope. CTC = total money company spends on you.

In-hand = after tax, PF, and other cuts.

Other benefits like HRA, PF, Gratuity = % of basic.

Fully taxable. Affects take-home + savings.

Yes. Usually appraisal or policy change time.

They must still follow labour laws + minimum wage rules.

A contributor to the Finanjo blog, where I share insightful and easy-to-understand content focused on educating readers about finance. With a clear and approachable writing style, I simplify complex topics to make them more understandable.

Ever opened your salary slip and felt completely lost? Your pay isn’t just a number it’s a mix of components, allowances, and deductions that decide your take-home salary. Understanding how your salary is structured can help you plan your finances smarter and know exactly where your money is going. Let’s unravel your paycheck and see what each component really means.

Think of your salary as the money your company gives you for showing up, working, stressing, replying to emails, and doing everything your job demands.

Whether you work in a government office, an MNC, a startup, a bank, or a local private firm your salary is the fixed amount you’re paid regularly, usually once a month, as part of your yearly package.

But here’s the catch:

That one neat number you see in the offer letter? It’s not just one thing.

Your salary is actually a combo pack of:

All these pieces together decide:

Now, when all these parts are arranged properly and given a structure, that’s what we call your salary structure.

So, what exactly is a Salary Structure?

A salary structure is basically the full breakup of your pay.

It shows how your total CTC is divided into basic salary, allowances, deductions, contributions, and so on.

This breakdown is usually created by the HR and payroll team.

They decide:

Even a small change in this structure…like increasing basic pay or changing an allowance can affect:

So, a salary structure isn’t just an HR formality.

It quietly decides how “rich” or “broke” you feel at the end of the month.

What actually makes up your salary?

When you get a job offer, they usually show you one big number as CTC and it looks very exciting. But when the first salary hits the account, it’s always less than what you imagined

That’s because your salary is not just one straight amount it’s made of different parts.

Here’s the basic breakup, in simple language:

It includes things like:

So if they say “CTC ₹6 lakh”, less than that will come to your account every month.

It includes:

No tax, PF or other deductions are removed yet. So this amount always looks bigger than what you actually receive.

This is the real amount you get in your bank every month.

Rough idea:

Take-home salary = Gross salary – (tax + PF + other deductions)

Whatever is left after all the cuts is your net salary, this is what you actually live on.

These are extra amounts your company gives for specific things, like:

Some of these can also help you save tax, if planned properly.

These are not always cash but extra benefits you get as an employee, for example:

They don’t always show up as “money in hand” but they do reduce your personal expenses.

This is the part that hurts a little the money that gets cut from your salary.

Common ones are:

Because of these cuts, your take-home becomes lower, but things like PF are actually forced savings for later.

This is the extra amount you can earn apart from your fixed salary.

It may come:

Not always guaranteed every month, but when it comes, mood automatically improves

Think of this as the core of your pay.

It’s the main chunk that usually makes up 35–50% of your total salary.

How it’s decided? Well… a mix of things:

Most of the other parts of your salary like PF, HRA, bonuses are usually calculated as a percentage of basic.

Taxes:

100% of your basic is taxable. So if your basic is ₹40,000 per month, the whole ₹40k is considered for income tax.

Okay, so allowances are basically extra money your company gives on top of your basic pay. Not just for fun they’re to cover things like rent, travel, medical stuff, etc.

Non-monetary benefits and additional payments:

| Component | Description | Taxability / Notes |

|---|---|---|

| Overtime | Extra pay for work beyond normal hours | Fully taxable |

| Bonus | Fixed amount for completing a year or on festivals | Fully taxable |

| Performance Incentive (PLI) | Bonus for outstanding results | Fully taxable |

| Salary Arrears | Retroactive payment due to salary revisions | Fully taxable |

| Travel / Food Reimbursement | Business-related expenses reimbursed | Tax-exempt if actual expense incurred |

| Gratuity | Lump sum after 5+ years of service | Fully exempt if due to retirement / superannuation / termination |

Gratuity = (Last Drawn Salary × 15 × Years of Service) ÷ 26

Subtracted from gross salary to meet statutory requirements:

| Deduction | Description |

|---|---|

| Employee Provident Fund (EPF) | 12% of Basic + DA contributed by employee; matched by employer. Provides retirement savings. |

| Professional Tax (PT) | State-specific; max ₹2,500/year. |

| Tax Deducted at Source (TDS) | Portion of income tax deducted monthly. Rate usually 10%, adjusted at year-end. |

| Employees’ State Insurance (ESIC) | Applicable if gross salary ≤ ₹21,000/month in organizations with 10+ employees. Provides medical & social security benefits. |

Example:

Think: Gross = total cake, Net = your slice

Figuring out your take-home salary (the money that actually hits your bank account) can feel confusing at first but if you break it down step by step, it’s quite simple. Let’s walk through it.

Your gross salary is basically your total earnings before any deductions. You can calculate it like this:

Think of gross salary as all the money you’ve earned before the government and other contributions take their share.

Next, figure out how much of your income is taxable.

What counts as deductions?

Popular Sections for Tax Deductions:

| Section | Purpose | Limit |

|---|---|---|

| 80C | Investments like PF, PPF, ELSS | ₹1.5 lakh |

| 80TTA | Savings account interest | ₹10,000 |

| 80G | Donations to charity | 50% of donation |

| 80E | Education loan interest | No limit |

| 80EE | Home loan interest | ₹50,000/year |

| 80D | Medical insurance premium | ₹25,000 (self & family), ₹55,000 (self + parents), ₹80,000 (self + senior citizen parents) |

Once you know your taxable income, calculate income tax according to the current slabs.

| Income Range (₹) | Tax Rate |

|---|---|

| Up to 4,00,000 | Nil |

| 4,00,001 – 8,00,000 | 5% |

| 8,00,001 – 12,00,000 | 10% |

| 12,00,001 – 16,00,000 | 15% |

| 16,00,001 – 20,00,000 | 20% |

| 20,00,001 – 24,00,000 | 25% |

| Above 24,00,000 | 30% |

Finally, subtract all deductions from your gross salary to get your take-home pay:

Let’s assume your CTC (Cost to Company) is ₹12,00,000 per year.

Here’s what gets deducted from your salary:

| Deduction Type | Amount (₹) | Notes |

|---|---|---|

| Professional Tax | 2,500 | Example: Maharashtra state PT |

| Employee Provident Fund (EPF) | 21,600 | 12% of ₹15,000/month (EPF salary cap) |

| Employee Insurance | 4,000 | Annual deduction |

| Total Deductions | 28,100 |

Note: Employer also contributes ₹21,600 to your EPF. This is part of your CTC but does not come out of your salary.

Now, subtract your deductions from gross salary:

Summary:

This format makes it clear, readable, and easy to understand for anyone trying to figure out their salary.

Good Salary Structure

Basically: good for you, good for company, legal.

Think of it like a breakup of your salary. Shows basic pay, allowances, bonuses, perks, deductions. Basically, tells you what actually lands in your account.

Not really. Usually it’s 35–50%, depends on your company, role, city. So don’t panic if it’s less.

Mostly govt jobs. Part of the 7th Pay Commission pay matrix. Private jobs? Forget it.

CTC = Basic + HRA + Allowances + Bonus + PF + Gratuity + Insurance + Perks.

Your in-hand is just one part of this big number.

It’s a tool online. You put CTC, basic, HRA, city, investments. It tells you your take-home salary, tax, deductions. Super handy.

Rule says: Basic + DA ≥ 50% of CTC.

Good thing: PF & gratuity go up. Slight downside: take-home may drop a bit.

HRA, DA, Conveyance, Medical, LTA, Special Allowance.

Some can save you tax if used smartly.

Nope. CTC = total money company spends on you.

In-hand = after tax, PF, and other cuts.

Other benefits like HRA, PF, Gratuity = % of basic.

Fully taxable. Affects take-home + savings.

Yes. Usually appraisal or policy change time.

They must still follow labour laws + minimum wage rules.

A contributor to the Finanjo blog, where I share insightful and easy-to-understand content focused on educating readers about finance. With a clear and approachable writing style, I simplify complex topics to make them more understandable.