A bank account is the first step to managing your money, but picking the right type is important. Savings Accounts and Current Accounts are the two most common options, each designed for different financial needs. A Savings Account helps people grow their money with interest. A Current Account is for businesses that need to handle many transactions. Knowing the key differences can help you make better banking choices.

In this blog, we will explain how both accounts work and which one is best for you.

One kind of bank account that helps people save money safely and earn interest on their deposits is a savings account. It is intended for those who wish to increase their savings over time, keep their money secure, and have easy access to it.

A current account is a kind of bank account intended for people and companies that must conduct high-value, frequent transactions. Although it typically doesn’t pay interest like a savings account, it’s perfect for business operations because it offers overdraft protection, limitless transactions, and easy cash flow management.

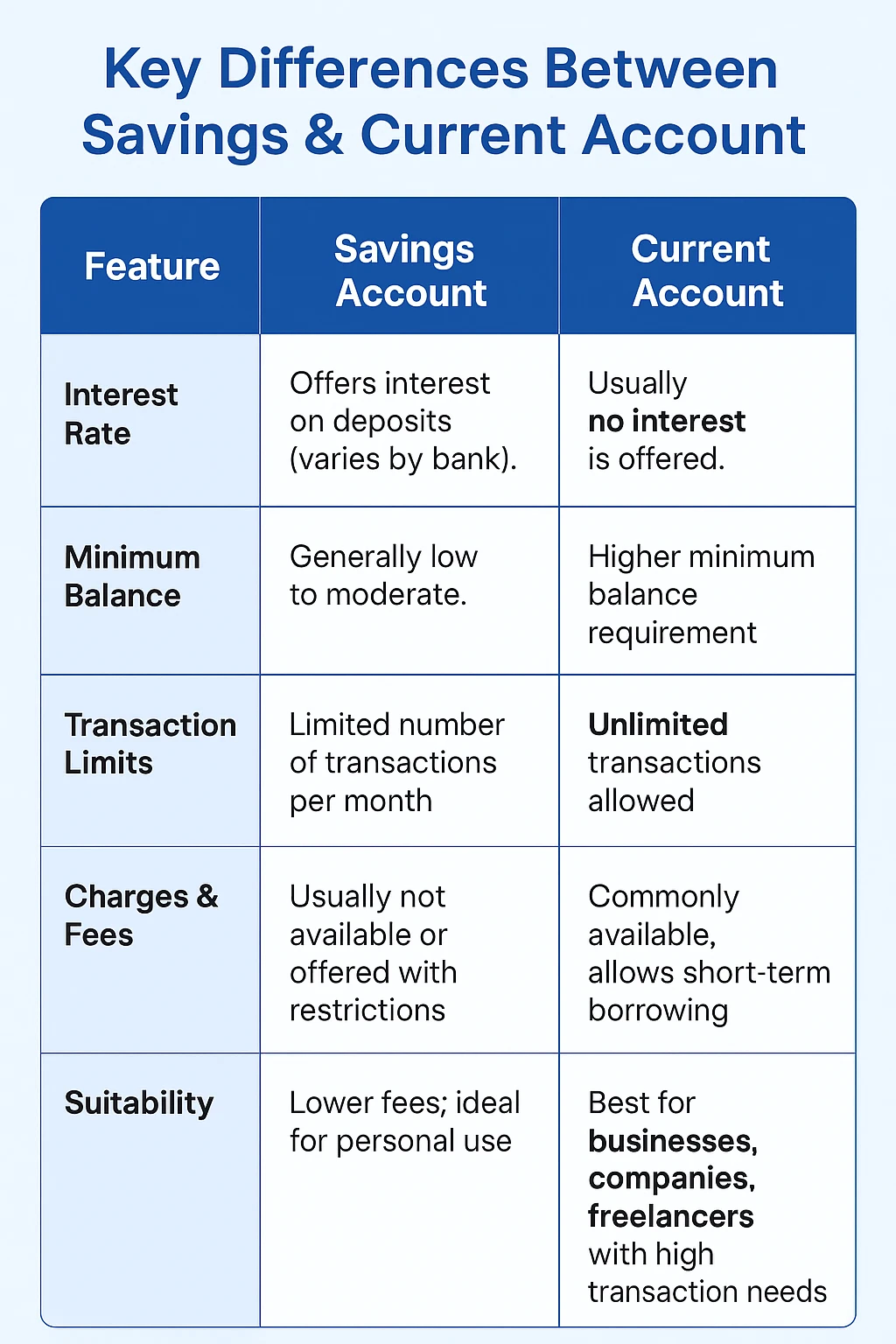

| Feature | Savings Account | Current Account |

|---|---|---|

| Interest Rate | Offers interest on deposits (varies by bank). | Usually no interest is offered. |

| Minimum Balance | Generally low to moderate. | Higher minimum balance requirement. |

| Transaction Limits | Limited number of transactions per month. | Unlimited transactions allowed. |

| Overdraft Facility | Usually not available or offered with restrictions. | Commonly available, allows short-term borrowing. |

| Charges & Fees | Lower fees; ideal for personal use. | Higher fees due to business-related services. |

| Suitability | Best for individuals saving money. | Best for businesses, companies, freelancers with high transaction needs. |

Your savings increase over time as a result of the interest you receive on the funds held in your account.

Because most banks have low or moderate minimum balance requirements, families, salaried individuals, and students can all use them.3. Withdrawals from ATMs and Debit Cards

Debit cards are given to account holders so they can easily pay their bills, make purchases, and withdraw cash whenever they want.

Net banking and mobile apps for bill payment, balance checks, fund transfers, and much more are included with savings accounts.

Banks may restrict the quantity of free transactions in order to promote thrifty saving practices.

Banking regulations safeguard your money, providing a secure location for both daily savings and emergencies.

You can set up automatic payments for EMIs, bills, SIPs, and recurring transfers.

Current accounts are perfect for businesses with regular financial activity because they permit unlimited deposits and withdrawals.

For temporary business needs, the majority of banks provide an overdraft facility that enables account holders to take out more money than their balance.

Since current accounts are meant for transactions rather than savings, they usually don’t offer interest.

Because of the wide range of services they offer, banks have a higher minimum balance requirement than savings accounts.

facilitates quick business transactions, including bulk payments, instant fund transfers, RTGS, NEFT, and IMPS.

Multiple check books, payment gateways, point-of-sale devices, and other business-oriented services are provided to account holders.

These accounts often come with higher service costs due to unlimited transactions and premium business features.

Best Option: Savings Account

Why? Low minimum balance, interest earnings, and essential services like ATM withdrawals and UPI payments.

Best Option: Savings Account

Why? Ideal for receiving salary, saving monthly income, and earning interest.

Use Current Account Only If: You run a side business requiring frequent transactions.

Savings Account: Offers interest (usually 2.5% to 6% depending on the bank).

Current Account: No interest or very minimal interest.

Savings Account: Low to moderate (₹0–₹10,000 depending on the bank & account type).

Current Account: High minimum balance (₹10,000–₹1,00,000+ depending on business type).

Savings Account: Limited free transactions per month; restrictions on cash deposits/withdrawals.

Current Account: Unlimited transactions—perfect for businesses with daily financial activity.

Savings Account: Low charges; penalties for not maintaining minimum balance are also low.

Current Account: Higher fees for non-maintenance, cheque books, cash handling, and other business services.

Aadhaar Card

PAN Card

Passport-size photographs

Address proof (utility bill, rental agreement, passport, etc.)

Basic KYC form

PAN & Aadhaar of proprietor/partners/directors

Proof of business (GST certificate, Shop Act, business registration)

Partnership deed or Memorandum of Association (MoA) / Articles of Association (AoA)

Address proof of business

Identity proofs of authorized signatories

Passport-size photographs

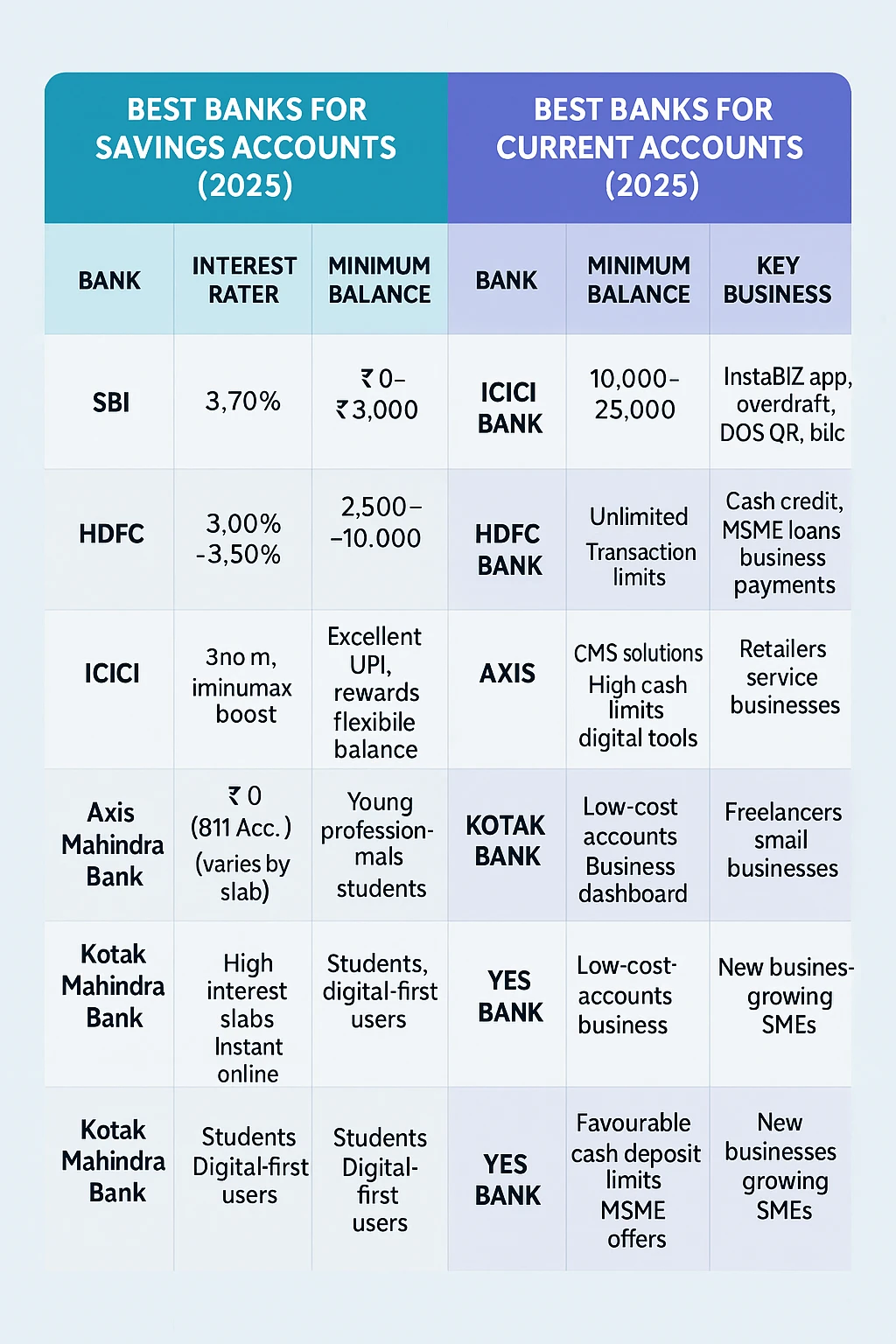

| Bank | Interest Rate Range | Minimum Balance | Key Features | Best For |

|---|---|---|---|---|

| SBI | 2.70% | ₹0–₹3,000 | Wide branch/ATM network, zero-balance accounts | Students, rural users, families |

| HDFC Bank | 3.00%–3.50% | ₹2,500–₹10,000 | Great mobile banking, premium debit cards | Salaried individuals, urban users |

| ICICI Bank | 3.00%–3.50% | ₹2,500–₹10,000 | Excellent UPI, rewards, flexible balance | Professionals, daily banking users |

| Axis Bank | 3.00%–3.50% | ₹2,500–₹10,000 | Fast onboarding, good digital services | Young professionals & students |

| Kotak Mahindra Bank | 3.50%–4.00% (varies by slab) | ₹0 (811 Account) | High interest slabs, instant online opening | Students, digital-first users |

| Bank | Minimum Balance | Transaction Limits | Key Business Features | Best For |

|---|---|---|---|---|

| ICICI Bank | ₹10,000–₹25,000 | Unlimited | InstaBIZ app, overdraft, POS/QR, bulk transfers | SMEs, startups, enterprises |

| HDFC Bank | ₹10,000–₹25,000 | Unlimited | Cash credit, MSME loans, business payments | Retailers, service businesses |

| Axis Bank | ₹10,000–₹50,000 | Unlimited | CMS solutions, high cash limits, digital tools | Traders, wholesalers |

| Kotak Mahindra Bank | ₹10,000–₹50,000 | Unlimited | Low-cost accounts, business dashboard | Freelancers, small businesses |

| Yes Bank | ₹10,000–₹25,000 | High transaction limits | Favourable cash deposit limits, MSME offers | New businesses, growing SMEs |

Many believe only large businesses can open Current Accounts. In reality, freelancers, shop owners, startups, and small businesses can also open them.

Not true—interest rates depend on the bank and may be low or fixed. Some digital banks offer better interest than traditional ones.

While possible, it’s not recommended. Frequent transactions may lead to charges, restrictions, or account monitoring.

Some banks offer affordable or low-cost current accounts, especially for small businesses and freelancers.

Most Savings Accounts have limits on free ATM withdrawals, cash deposits, and branch transactions.

Both Savings and Current Accounts are equally secure because they are governed by the Reserve Bank of India (RBI) and protected under the Deposit Insurance and Credit Guarantee Corporation (DICGC).

Highly secure for personal savings

Protected up to ₹5 lakh per depositor (DICGC insurance)

Lower transaction volume reduces fraud risk

Ideal for storing emergency funds and savings

Equally protected under ₹5 lakh DICGC insurance

Additional security tools for businesses like OTP-based payments, token devices, and dual authorization

High transaction volume means users must stay more alert.

Ans: A Savings Account is for personal savings and earns interest, while a Current Account is for businesses and supports unlimited transactions.

Ans: You can, but it’s not recommended because frequent transactions may lead to charges or account restrictions.

Ans: No, most Current Accounts do not offer interest as they are designed for business transactions.

Ans: A Savings Account—it offers low minimum balance, interest, and basic banking features.

Ans: Yes, but it is usually low. Some banks also offer zero-balance accounts.

Ans: Aadhaar, PAN, address proof, passport-size photos, and basic KYC details.

Ans: Business registration proof, GST certificate, PAN, Aadhaar, address proof, and authorized signatory documents.

Ans: Yes, freelancers and self-employed individuals can open a Current Account.

Ans: Both are equally safe and protected under DICGC insurance up to ₹5 lakh.

Choosing between a Savings Account and a Current Account depends entirely on your financial needs. If you are a student, salaried employee, or someone looking to save money and earn interest, a Savings Account is the best option. It offers security, interest earnings, and low minimum balance requirements.

On the other hand, if you are a business owner, freelancer, shopkeeper, or company needing high-volume transactions, overdraft facilities, and flexible cash flow, a Current Account is the right choice. It is designed specifically for daily business operations.

I’m a contributor at Finanjo, where I write about personal finance, banking, and everyday money topics in a clear and practical way. I simplify complex finance jargon into easy explanations and real-life insights, covering everything from bank accounts and deposits to government schemes and smart money decisions so readers can understand finance without the confusion.

A bank account is the first step to managing your money, but picking the right type is important. Savings Accounts and Current Accounts are the two most common options, each designed for different financial needs. A Savings Account helps people grow their money with interest. A Current Account is for businesses that need to handle many transactions. Knowing the key differences can help you make better banking choices.

In this blog, we will explain how both accounts work and which one is best for you.

One kind of bank account that helps people save money safely and earn interest on their deposits is a savings account. It is intended for those who wish to increase their savings over time, keep their money secure, and have easy access to it.

A current account is a kind of bank account intended for people and companies that must conduct high-value, frequent transactions. Although it typically doesn’t pay interest like a savings account, it’s perfect for business operations because it offers overdraft protection, limitless transactions, and easy cash flow management.

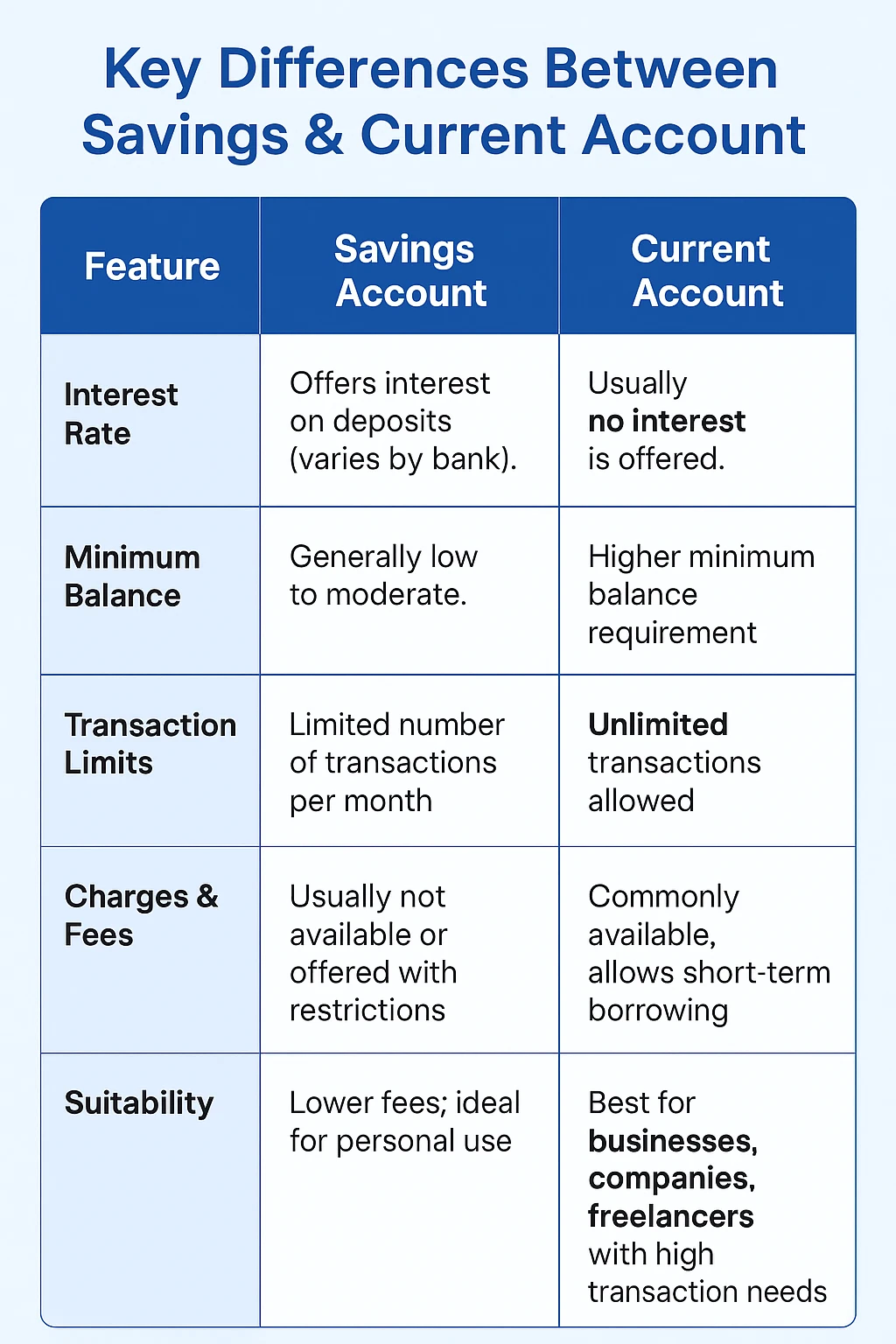

| Feature | Savings Account | Current Account |

|---|---|---|

| Interest Rate | Offers interest on deposits (varies by bank). | Usually no interest is offered. |

| Minimum Balance | Generally low to moderate. | Higher minimum balance requirement. |

| Transaction Limits | Limited number of transactions per month. | Unlimited transactions allowed. |

| Overdraft Facility | Usually not available or offered with restrictions. | Commonly available, allows short-term borrowing. |

| Charges & Fees | Lower fees; ideal for personal use. | Higher fees due to business-related services. |

| Suitability | Best for individuals saving money. | Best for businesses, companies, freelancers with high transaction needs. |

Your savings increase over time as a result of the interest you receive on the funds held in your account.

Because most banks have low or moderate minimum balance requirements, families, salaried individuals, and students can all use them.3. Withdrawals from ATMs and Debit Cards

Debit cards are given to account holders so they can easily pay their bills, make purchases, and withdraw cash whenever they want.

Net banking and mobile apps for bill payment, balance checks, fund transfers, and much more are included with savings accounts.

Banks may restrict the quantity of free transactions in order to promote thrifty saving practices.

Banking regulations safeguard your money, providing a secure location for both daily savings and emergencies.

You can set up automatic payments for EMIs, bills, SIPs, and recurring transfers.

Current accounts are perfect for businesses with regular financial activity because they permit unlimited deposits and withdrawals.

For temporary business needs, the majority of banks provide an overdraft facility that enables account holders to take out more money than their balance.

Since current accounts are meant for transactions rather than savings, they usually don’t offer interest.

Because of the wide range of services they offer, banks have a higher minimum balance requirement than savings accounts.

facilitates quick business transactions, including bulk payments, instant fund transfers, RTGS, NEFT, and IMPS.

Multiple check books, payment gateways, point-of-sale devices, and other business-oriented services are provided to account holders.

These accounts often come with higher service costs due to unlimited transactions and premium business features.

Best Option: Savings Account

Why? Low minimum balance, interest earnings, and essential services like ATM withdrawals and UPI payments.

Best Option: Savings Account

Why? Ideal for receiving salary, saving monthly income, and earning interest.

Use Current Account Only If: You run a side business requiring frequent transactions.

Savings Account: Offers interest (usually 2.5% to 6% depending on the bank).

Current Account: No interest or very minimal interest.

Savings Account: Low to moderate (₹0–₹10,000 depending on the bank & account type).

Current Account: High minimum balance (₹10,000–₹1,00,000+ depending on business type).

Savings Account: Limited free transactions per month; restrictions on cash deposits/withdrawals.

Current Account: Unlimited transactions—perfect for businesses with daily financial activity.

Savings Account: Low charges; penalties for not maintaining minimum balance are also low.

Current Account: Higher fees for non-maintenance, cheque books, cash handling, and other business services.

Aadhaar Card

PAN Card

Passport-size photographs

Address proof (utility bill, rental agreement, passport, etc.)

Basic KYC form

PAN & Aadhaar of proprietor/partners/directors

Proof of business (GST certificate, Shop Act, business registration)

Partnership deed or Memorandum of Association (MoA) / Articles of Association (AoA)

Address proof of business

Identity proofs of authorized signatories

Passport-size photographs

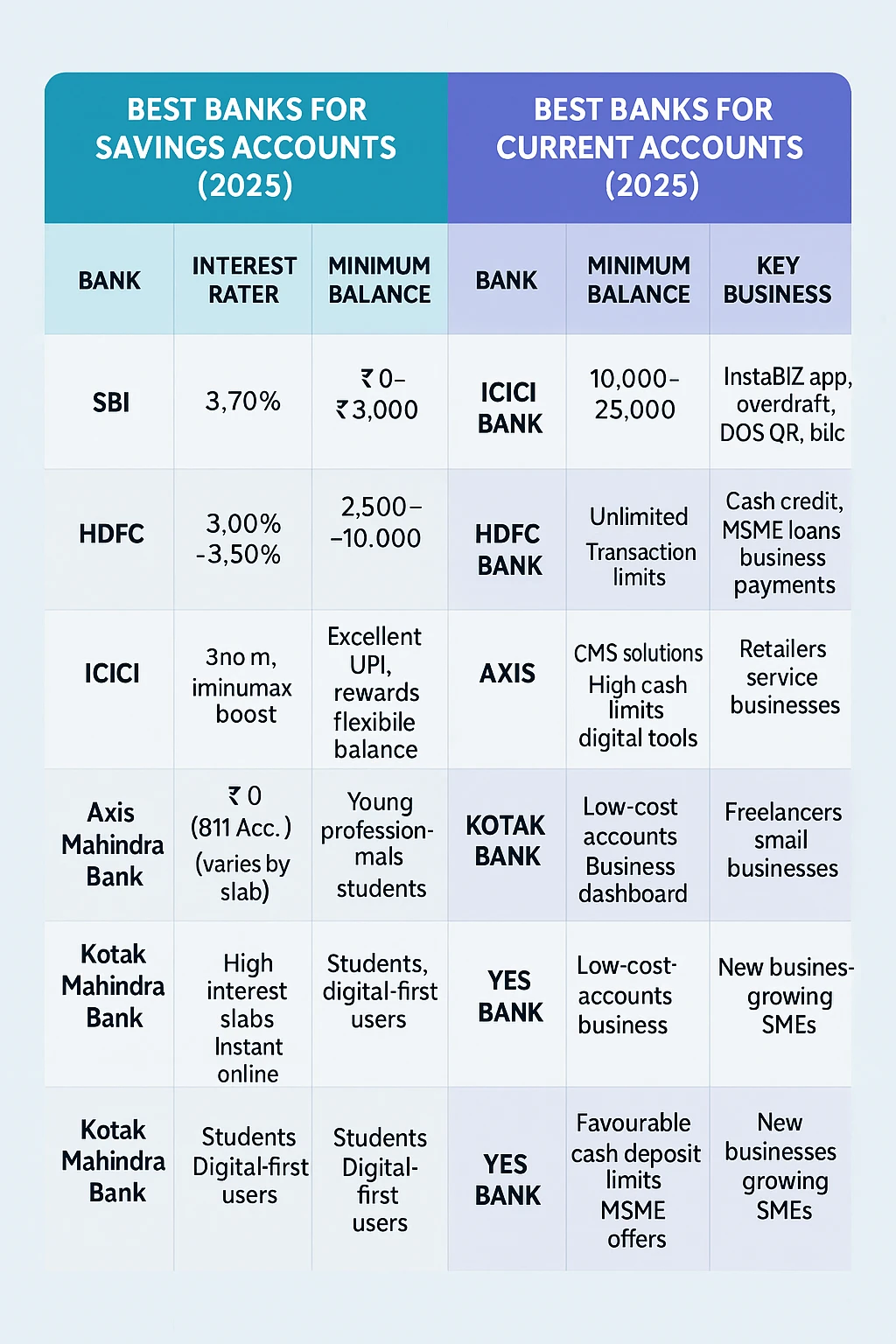

| Bank | Interest Rate Range | Minimum Balance | Key Features | Best For |

|---|---|---|---|---|

| SBI | 2.70% | ₹0–₹3,000 | Wide branch/ATM network, zero-balance accounts | Students, rural users, families |

| HDFC Bank | 3.00%–3.50% | ₹2,500–₹10,000 | Great mobile banking, premium debit cards | Salaried individuals, urban users |

| ICICI Bank | 3.00%–3.50% | ₹2,500–₹10,000 | Excellent UPI, rewards, flexible balance | Professionals, daily banking users |

| Axis Bank | 3.00%–3.50% | ₹2,500–₹10,000 | Fast onboarding, good digital services | Young professionals & students |

| Kotak Mahindra Bank | 3.50%–4.00% (varies by slab) | ₹0 (811 Account) | High interest slabs, instant online opening | Students, digital-first users |

| Bank | Minimum Balance | Transaction Limits | Key Business Features | Best For |

|---|---|---|---|---|

| ICICI Bank | ₹10,000–₹25,000 | Unlimited | InstaBIZ app, overdraft, POS/QR, bulk transfers | SMEs, startups, enterprises |

| HDFC Bank | ₹10,000–₹25,000 | Unlimited | Cash credit, MSME loans, business payments | Retailers, service businesses |

| Axis Bank | ₹10,000–₹50,000 | Unlimited | CMS solutions, high cash limits, digital tools | Traders, wholesalers |

| Kotak Mahindra Bank | ₹10,000–₹50,000 | Unlimited | Low-cost accounts, business dashboard | Freelancers, small businesses |

| Yes Bank | ₹10,000–₹25,000 | High transaction limits | Favourable cash deposit limits, MSME offers | New businesses, growing SMEs |

Many believe only large businesses can open Current Accounts. In reality, freelancers, shop owners, startups, and small businesses can also open them.

Not true—interest rates depend on the bank and may be low or fixed. Some digital banks offer better interest than traditional ones.

While possible, it’s not recommended. Frequent transactions may lead to charges, restrictions, or account monitoring.

Some banks offer affordable or low-cost current accounts, especially for small businesses and freelancers.

Most Savings Accounts have limits on free ATM withdrawals, cash deposits, and branch transactions.

Both Savings and Current Accounts are equally secure because they are governed by the Reserve Bank of India (RBI) and protected under the Deposit Insurance and Credit Guarantee Corporation (DICGC).

Highly secure for personal savings

Protected up to ₹5 lakh per depositor (DICGC insurance)

Lower transaction volume reduces fraud risk

Ideal for storing emergency funds and savings

Equally protected under ₹5 lakh DICGC insurance

Additional security tools for businesses like OTP-based payments, token devices, and dual authorization

High transaction volume means users must stay more alert.

Ans: A Savings Account is for personal savings and earns interest, while a Current Account is for businesses and supports unlimited transactions.

Ans: You can, but it’s not recommended because frequent transactions may lead to charges or account restrictions.

Ans: No, most Current Accounts do not offer interest as they are designed for business transactions.

Ans: A Savings Account—it offers low minimum balance, interest, and basic banking features.

Ans: Yes, but it is usually low. Some banks also offer zero-balance accounts.

Ans: Aadhaar, PAN, address proof, passport-size photos, and basic KYC details.

Ans: Business registration proof, GST certificate, PAN, Aadhaar, address proof, and authorized signatory documents.

Ans: Yes, freelancers and self-employed individuals can open a Current Account.

Ans: Both are equally safe and protected under DICGC insurance up to ₹5 lakh.

Choosing between a Savings Account and a Current Account depends entirely on your financial needs. If you are a student, salaried employee, or someone looking to save money and earn interest, a Savings Account is the best option. It offers security, interest earnings, and low minimum balance requirements.

On the other hand, if you are a business owner, freelancer, shopkeeper, or company needing high-volume transactions, overdraft facilities, and flexible cash flow, a Current Account is the right choice. It is designed specifically for daily business operations.

I’m a contributor at Finanjo, where I write about personal finance, banking, and everyday money topics in a clear and practical way. I simplify complex finance jargon into easy explanations and real-life insights, covering everything from bank accounts and deposits to government schemes and smart money decisions so readers can understand finance without the confusion.