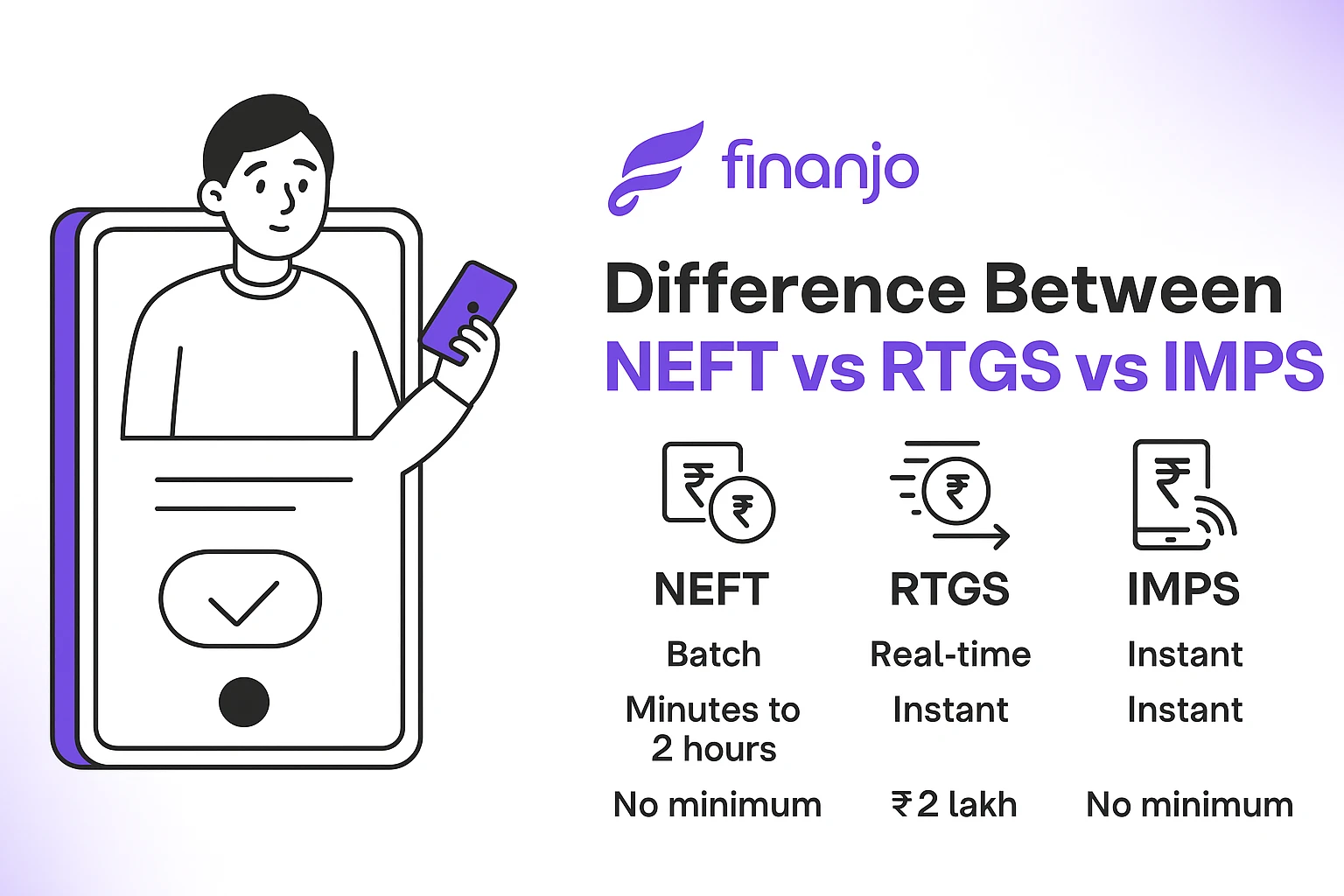

Money transfers are now safer, quicker, and more convenient than ever thanks to digital banking. The three most widely used electronic fund transfer systems in India are NEFT, RTGS, and IMPS. Although all three facilitate money transfers between bank accounts, their optimal use cases, settlement methods, transaction limits, and speeds vary. Understanding the Difference Between NEFT, RTGS and IMPS helps you choose the most suitable method for your specific banking needs.

NEFT (National Electronic Funds Transfer) is an electronic payment system introduced by the Reserve Bank of India (RBI) that allows individuals and businesses to transfer money from one bank account to another across all banks in India.

Batch-Based Settlement: Transactions are processed in half-hourly batches throughout the day.

24×7 Availability: Works round the clock, including Sundays and bank holidays.

No Minimum or Maximum Limit: Suitable for small, medium, and large payments.

Safe and Secure: Regulated by the RBI.

Charges: Usually free for online NEFT transactions.

Processing Time: Typically a few minutes to a maximum of 1–2 hours depending on batch timing.

Sender initiates a transfer using net banking/mobile banking.

The bank sends the request to the NEFT clearing center.

The transaction is settled in the next available batch.

Amount is credited to the beneficiary’s account.

Routine payments

Vendor/salary transfers

Utility bills

Personal transfers

EMI & loan payments

RTGS (Real-Time Gross Settlement) is a high-value electronic fund transfer system where money is transferred instantly and individually (not in batches). It is designed for urgent and large-value transactions.

Real-Time Processing: Funds are transferred immediately without waiting for batch settlements.

Gross Settlement: Each transaction is processed one-to-one, not combined with others.

Minimum Amount: ₹2 lakh.

No Maximum Limit: Suitable for very large transactions.

Availability: 24×7, including Sundays and bank holidays.

Secure and RBI-Regulated: Ensures high-level safety for large payments.

Charges: Typically free for online transfers.

Sender initiates an RTGS request through internet banking or a bank branch.

The bank debits the sender’s account and sends the request to the RTGS system.

The transfer is processed instantly, and funds are credited to the beneficiary’s bank in real-time.

The beneficiary receives the amount within seconds.

High-value payments

Immediate business transfers

Property transactions

Corporate and B2B payments

Urgent transactions requiring guaranteed clearance

IMPS (Immediate Payment Service) is a fast and secure electronic payment system that enables instant money transfers 24×7, even during nights, weekends, and bank holidays. It is widely used for quick personal transactions and emergency payments.

Instant Real-Time Transfer: Funds are credited within seconds.

24×7 Availability: Works round the clock, including Sundays and public holidays.

Flexible Transfer Limits: No minimum amount; maximum limit is usually up to ₹5 lakh (varies by bank).

Highly Secure: Uses multi-factor authentication.

Multiple Transfer Methods:

Mobile number + MMID

Account number + IFSC

UPI infrastructure (many UPI payments run on IMPS rails)

Charges: Most banks offer IMPS free of cost for online transactions.

Sender initiates a transfer using mobile banking or net banking.

The bank processes the request instantly through the IMPS system (NPCI).

Funds are credited to the beneficiary’s account in real-time.

Sender and recipient both receive confirmation messages.

Instant personal transfers

Emergency payments

Small or medium-value transactions

Mobile-based banking

Payments outside banking hours

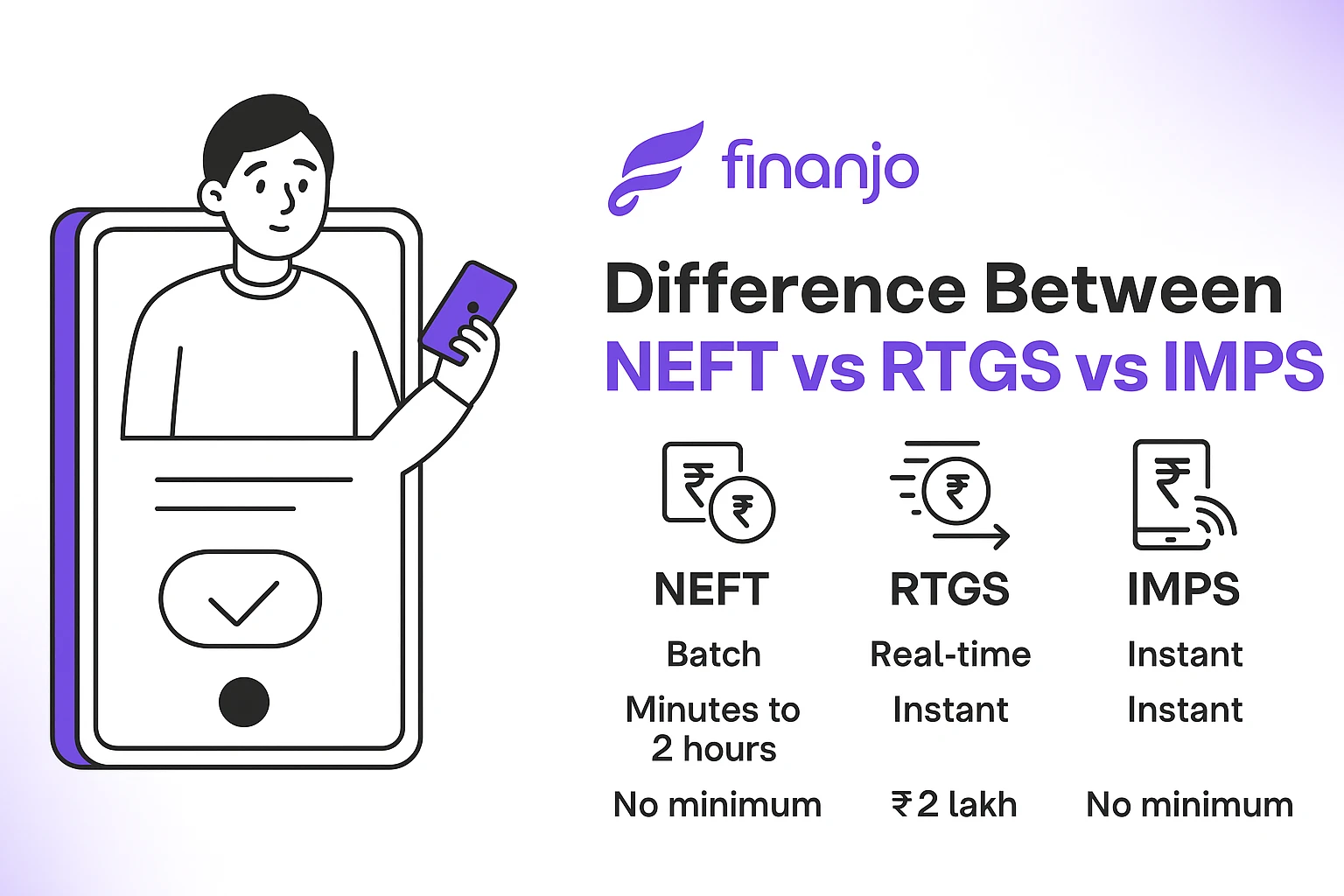

| Feature | NEFT | RTGS | IMPS |

|---|---|---|---|

| Settlement Type | Batch (half-hourly) | Real-time, one-to-one | Real-time |

| Speed | Minutes to 2 hours | Instant | Instant |

| Availability | 24×7 | 24×7 | 24×7 |

| Minimum Amount | No minimum | ₹2 lakh | No minimum |

| Maximum Amount | No limit | No limit | Up to ₹5 lakh (bank-specific) |

| Ideal For | Routine transfers | High-value, urgent transfers | Instant personal/emergency transfers |

| Charges | Usually free | Usually free | Usually free |

| Security Level | High | Very high | High |

| Details Required | Acc. no + IFSC | Acc. no + IFSC | Mobile + MMID or Acc. no + IFSC |

Each payment method – NEFT, RTGS, and IMPS – has different rules for how much money you can transfer. These limits help decide which method is best for small, medium, or high-value transactions.

NEFT does not have any minimum or maximum transfer limit set by the RBI.

This means you can send any amount, whether it’s ₹100 or ₹10 lakh.

Very flexible

Suitable for everyday payments

Ideal for individuals and businesses of all sizes

Some banks may set their own transaction caps, but RBI doesn’t impose limits.

RTGS is designed for high-value transfers and therefore has a minimum transaction amount of ₹2 lakh.

There is no upper limit for transferring funds through RTGS, especially when done online.

Best for large payments

Used for business, corporate, and property transactions

Not suitable for small transfers under ₹2 lakh

IMPS does not require a minimum amount—you can send even ₹1.

However, the maximum limit depends on your bank, usually between ₹2 lakh and ₹5 lakh.

Perfect for small & medium transfers

Works 24×7

Fastest option for emergency or personal transfers

Not suitable for very high-value payments above the bank’s IMPS limit

| Method | Pros | Cons |

|---|---|---|

| NEFT | • Free, safe, and widely used • Perfect for regular and routine payments |

• Not instant in some cases (batch-based processing) |

| RTGS | • Instant settlement • Ideal for high-value and urgent transfers |

• Minimum transfer amount of ₹2 lakh |

| IMPS | • Instant real-time transfer • Works 24×7, even on holidays |

• Daily/transaction limits may apply depending on the bank |

| Method | Online Charges | Branch Charges |

|---|---|---|

| NEFT | Free | ₹2.50–₹25 + GST |

| RTGS | Free | ₹25–₹50 + GST |

| IMPS | Usually free | ₹2–₹20 + GST |

Double-check the beneficiary’s account number — even one wrong digit can lead to failed or misdirected transfers.

Verify the IFSC code to ensure you’re sending money to the correct bank branch.

Confirm the beneficiary name to avoid mistakes or mismatches.

Choose the right transfer method (NEFT, RTGS, IMPS) based on urgency and transaction amount.

Check transfer limits — IMPS has bank-specific limits, RTGS requires ₹2 lakh minimum, NEFT has no RBI limit.

Make sure your account has sufficient balance, including extra charges if applicable.

Ensure you are using a secure network or device; avoid public Wi-Fi for safety.

Check your bank’s server or maintenance status to avoid delays.

Confirm branch timings if sending through offline NEFT or RTGS.

Keep transaction details or receipts saved for tracking or dispute resolution.

Check daily and per-transaction limits set by your bank for online transfers.

Ensure your mobile number is updated and active for OTP and alerts.

Be aware of frauds and phishing links; use only official banking apps/websites.

ANS: IMPS and RTGS are the fastest, offering instant real-time transfers. NEFT works in half-hourly batches and may take a few minutes to up to 2 hours.

ANS: Yes. NEFT is available 24×7, including Sundays and bank holidays.

ANS: RTGS requires a minimum transfer amount of ₹2 lakh.

ANS: IMPS does not have a fixed RBI limit, but most banks allow up to ₹2–₹5 lakh.

ANS: Online transfers are usually free. Branch-based transactions may have small charges + GST.

ANS: IMPS is best for urgent, immediate transfers anytime.

ANS: RTGS, because it is fast, secure, and supports large-value transactions.

ANS: Failures are rare, but may occur due to server downtime or incorrect details. Amount is refunded automatically in case of failed transactions.

ANS:

NEFT & RTGS: Yes, IFSC is mandatory.

IMPS: IFSC is required only for account-based transfers.

You can also use mobile number + MMID in IMPS.

ANS: No. NEFT, RTGS, and IMPS all work within India only.

NEFT, RTGS, and IMPS are three of the most widely used fund transfer methods in India, each serving a different purpose. NEFT is ideal for routine, non-urgent payments; RTGS is perfect for large, time-sensitive transactions; and IMPS is the best option for instant, emergency transfers available 24×7.

Understanding their speed, limits, charges, and use cases helps you choose the safest and most efficient method for your needs. Whether you’re paying bills, sending money instantly, or making high-value business transactions, picking the right option ensures smooth and secure fund transfers every time.

I’m a contributor at Finanjo, where I write about personal finance, banking, and everyday money topics in a clear and practical way. I simplify complex finance jargon into easy explanations and real-life insights, covering everything from bank accounts and deposits to government schemes and smart money decisions so readers can understand finance without the confusion.

Money transfers are now safer, quicker, and more convenient than ever thanks to digital banking. The three most widely used electronic fund transfer systems in India are NEFT, RTGS, and IMPS. Although all three facilitate money transfers between bank accounts, their optimal use cases, settlement methods, transaction limits, and speeds vary. Understanding the Difference Between NEFT, RTGS and IMPS helps you choose the most suitable method for your specific banking needs.

NEFT (National Electronic Funds Transfer) is an electronic payment system introduced by the Reserve Bank of India (RBI) that allows individuals and businesses to transfer money from one bank account to another across all banks in India.

Batch-Based Settlement: Transactions are processed in half-hourly batches throughout the day.

24×7 Availability: Works round the clock, including Sundays and bank holidays.

No Minimum or Maximum Limit: Suitable for small, medium, and large payments.

Safe and Secure: Regulated by the RBI.

Charges: Usually free for online NEFT transactions.

Processing Time: Typically a few minutes to a maximum of 1–2 hours depending on batch timing.

Sender initiates a transfer using net banking/mobile banking.

The bank sends the request to the NEFT clearing center.

The transaction is settled in the next available batch.

Amount is credited to the beneficiary’s account.

Routine payments

Vendor/salary transfers

Utility bills

Personal transfers

EMI & loan payments

RTGS (Real-Time Gross Settlement) is a high-value electronic fund transfer system where money is transferred instantly and individually (not in batches). It is designed for urgent and large-value transactions.

Real-Time Processing: Funds are transferred immediately without waiting for batch settlements.

Gross Settlement: Each transaction is processed one-to-one, not combined with others.

Minimum Amount: ₹2 lakh.

No Maximum Limit: Suitable for very large transactions.

Availability: 24×7, including Sundays and bank holidays.

Secure and RBI-Regulated: Ensures high-level safety for large payments.

Charges: Typically free for online transfers.

Sender initiates an RTGS request through internet banking or a bank branch.

The bank debits the sender’s account and sends the request to the RTGS system.

The transfer is processed instantly, and funds are credited to the beneficiary’s bank in real-time.

The beneficiary receives the amount within seconds.

High-value payments

Immediate business transfers

Property transactions

Corporate and B2B payments

Urgent transactions requiring guaranteed clearance

IMPS (Immediate Payment Service) is a fast and secure electronic payment system that enables instant money transfers 24×7, even during nights, weekends, and bank holidays. It is widely used for quick personal transactions and emergency payments.

Instant Real-Time Transfer: Funds are credited within seconds.

24×7 Availability: Works round the clock, including Sundays and public holidays.

Flexible Transfer Limits: No minimum amount; maximum limit is usually up to ₹5 lakh (varies by bank).

Highly Secure: Uses multi-factor authentication.

Multiple Transfer Methods:

Mobile number + MMID

Account number + IFSC

UPI infrastructure (many UPI payments run on IMPS rails)

Charges: Most banks offer IMPS free of cost for online transactions.

Sender initiates a transfer using mobile banking or net banking.

The bank processes the request instantly through the IMPS system (NPCI).

Funds are credited to the beneficiary’s account in real-time.

Sender and recipient both receive confirmation messages.

Instant personal transfers

Emergency payments

Small or medium-value transactions

Mobile-based banking

Payments outside banking hours

| Feature | NEFT | RTGS | IMPS |

|---|---|---|---|

| Settlement Type | Batch (half-hourly) | Real-time, one-to-one | Real-time |

| Speed | Minutes to 2 hours | Instant | Instant |

| Availability | 24×7 | 24×7 | 24×7 |

| Minimum Amount | No minimum | ₹2 lakh | No minimum |

| Maximum Amount | No limit | No limit | Up to ₹5 lakh (bank-specific) |

| Ideal For | Routine transfers | High-value, urgent transfers | Instant personal/emergency transfers |

| Charges | Usually free | Usually free | Usually free |

| Security Level | High | Very high | High |

| Details Required | Acc. no + IFSC | Acc. no + IFSC | Mobile + MMID or Acc. no + IFSC |

Each payment method – NEFT, RTGS, and IMPS – has different rules for how much money you can transfer. These limits help decide which method is best for small, medium, or high-value transactions.

NEFT does not have any minimum or maximum transfer limit set by the RBI.

This means you can send any amount, whether it’s ₹100 or ₹10 lakh.

Very flexible

Suitable for everyday payments

Ideal for individuals and businesses of all sizes

Some banks may set their own transaction caps, but RBI doesn’t impose limits.

RTGS is designed for high-value transfers and therefore has a minimum transaction amount of ₹2 lakh.

There is no upper limit for transferring funds through RTGS, especially when done online.

Best for large payments

Used for business, corporate, and property transactions

Not suitable for small transfers under ₹2 lakh

IMPS does not require a minimum amount—you can send even ₹1.

However, the maximum limit depends on your bank, usually between ₹2 lakh and ₹5 lakh.

Perfect for small & medium transfers

Works 24×7

Fastest option for emergency or personal transfers

Not suitable for very high-value payments above the bank’s IMPS limit

| Method | Pros | Cons |

|---|---|---|

| NEFT | • Free, safe, and widely used • Perfect for regular and routine payments |

• Not instant in some cases (batch-based processing) |

| RTGS | • Instant settlement • Ideal for high-value and urgent transfers |

• Minimum transfer amount of ₹2 lakh |

| IMPS | • Instant real-time transfer • Works 24×7, even on holidays |

• Daily/transaction limits may apply depending on the bank |

| Method | Online Charges | Branch Charges |

|---|---|---|

| NEFT | Free | ₹2.50–₹25 + GST |

| RTGS | Free | ₹25–₹50 + GST |

| IMPS | Usually free | ₹2–₹20 + GST |

Double-check the beneficiary’s account number — even one wrong digit can lead to failed or misdirected transfers.

Verify the IFSC code to ensure you’re sending money to the correct bank branch.

Confirm the beneficiary name to avoid mistakes or mismatches.

Choose the right transfer method (NEFT, RTGS, IMPS) based on urgency and transaction amount.

Check transfer limits — IMPS has bank-specific limits, RTGS requires ₹2 lakh minimum, NEFT has no RBI limit.

Make sure your account has sufficient balance, including extra charges if applicable.

Ensure you are using a secure network or device; avoid public Wi-Fi for safety.

Check your bank’s server or maintenance status to avoid delays.

Confirm branch timings if sending through offline NEFT or RTGS.

Keep transaction details or receipts saved for tracking or dispute resolution.

Check daily and per-transaction limits set by your bank for online transfers.

Ensure your mobile number is updated and active for OTP and alerts.

Be aware of frauds and phishing links; use only official banking apps/websites.

ANS: IMPS and RTGS are the fastest, offering instant real-time transfers. NEFT works in half-hourly batches and may take a few minutes to up to 2 hours.

ANS: Yes. NEFT is available 24×7, including Sundays and bank holidays.

ANS: RTGS requires a minimum transfer amount of ₹2 lakh.

ANS: IMPS does not have a fixed RBI limit, but most banks allow up to ₹2–₹5 lakh.

ANS: Online transfers are usually free. Branch-based transactions may have small charges + GST.

ANS: IMPS is best for urgent, immediate transfers anytime.

ANS: RTGS, because it is fast, secure, and supports large-value transactions.

ANS: Failures are rare, but may occur due to server downtime or incorrect details. Amount is refunded automatically in case of failed transactions.

ANS:

NEFT & RTGS: Yes, IFSC is mandatory.

IMPS: IFSC is required only for account-based transfers.

You can also use mobile number + MMID in IMPS.

ANS: No. NEFT, RTGS, and IMPS all work within India only.

NEFT, RTGS, and IMPS are three of the most widely used fund transfer methods in India, each serving a different purpose. NEFT is ideal for routine, non-urgent payments; RTGS is perfect for large, time-sensitive transactions; and IMPS is the best option for instant, emergency transfers available 24×7.

Understanding their speed, limits, charges, and use cases helps you choose the safest and most efficient method for your needs. Whether you’re paying bills, sending money instantly, or making high-value business transactions, picking the right option ensures smooth and secure fund transfers every time.

I’m a contributor at Finanjo, where I write about personal finance, banking, and everyday money topics in a clear and practical way. I simplify complex finance jargon into easy explanations and real-life insights, covering everything from bank accounts and deposits to government schemes and smart money decisions so readers can understand finance without the confusion.