Banks and Non-Banking Financial Companies (NBFCs) are both integral parts of the financial sector, but they serve different purposes and operate under different regulations. Understanding these differences is crucial for anyone looking to navigate the financial landscape effectively.

This blog provides a detailed comparison between banks and NBFCs, helping you understand their respective roles and how they impact your financial decisions.

Banks and NBFCs are the two crucial financial intermediaries in any financial system. Banks are traditional entities that accept deposits from the public and provide loans to the public, while NBFCs offer various financial services to consumers without a banking license.

What is a Bank?

A bank is a financial institution licensed to accept deposits, give out loans, and provide other financial services to the public. Banks are regulated by central authorities such as the Federal Reserve in the United States or the Reserve Bank of India (RBI) in India. They play a crucial role in the economy by facilitating the flow of money and providing essential services like savings accounts, checking accounts, and mortgages

Functions of Banks

1. Accepting Deposits

-

Savings Accounts: These accounts allow individuals to deposit money and earn interest over time. They are designed for long-term savings.

-

Current Accounts: These accounts are designed for businesses and individuals who need to make frequent transactions. They usually do not earn interest but provide easy access to funds.

-

Fixed Deposits: These are term deposits where the depositor agrees to keep the money in the bank for a fixed period in exchange for a higher interest rate.

2. Granting Loans and Advances

-

Personal Loans: These are unsecured loans given to individuals for various purposes such as buying a car, home improvement, or education.

-

Mortgages: These are long-term loans secured by real estate. The property serves as collateral, and the bank has the right to seize it if the borrower defaults.

-

Business Loans: These are loans provided to businesses to help them expand, purchase inventory, or invest in new equipment.

-

Overdraft Facilities: These allow account holders to withdraw more money than they have in their account up to a pre-agreed limit.

3. Credit Creation

-

Banks create credit by lending money. When a bank gives out a loan, it essentially creates new money in the economy. This process is known as the “money multiplier effect,” where a small amount of reserves can lead to a much larger amount of credit.

4. Payment and Settlement Services

-

Cheques: Banks facilitate the transfer of money through cheques, which are written orders to pay a specified amount of money to a designated person or entity.

-

Electronic Transfers: Banks provide services like wire transfers, direct debits, and online banking to facilitate quick and secure money transfers.

-

Credit and Debit Cards: These cards allow customers to make purchases and withdraw cash from ATMs, providing a convenient way to access funds.

5. Foreign Exchange Services

-

Banks deal in foreign currencies, providing services such as currency exchange, foreign drafts, and telegraphic transfers. They help businesses and individuals manage foreign currency transactions and hedge against exchange rate risks.

6. Safekeeping and Custody Services

-

Safety Deposit Boxes: Banks offer secure storage for valuable items such as jewelry, important documents, and other assets.

-

Custody Services: Banks act as custodians for securities and other financial assets, ensuring their safekeeping and facilitating transactions.

7. Investment Services

-

Brokerage Services: Some banks offer brokerage services, allowing customers to buy and sell stocks, bonds, and other securities.

-

Wealth Management: Banks provide advice and management services for high-net-worth individuals, helping them invest their wealth in various financial instruments.

8. Financial Advice and Consulting

9. Issuing Letters of Credit

10. Economic Stability and Development

11. Regulatory and Compliance Functions

-

Banks are subject to strict regulations to ensure financial stability and protect consumers. They must comply with laws related to anti-money laundering, consumer protection, and capital adequacy requirements.

Features of banks

1. Accepting Deposits

-

Savings Accounts: These accounts allow individuals to deposit money and earn interest over time. They are designed for long-term savings.

-

Checking Accounts: These accounts are used for day-to-day transactions. They typically offer no interest but provide easy access to funds through checks, ATMs, and electronic transfers.

-

Time Deposits (Certificates of Deposit): These are deposits that are held for a fixed period, with interest paid at maturity. They usually offer higher interest rates than savings accounts.

2. Granting Loans and Advances

-

Personal Loans: These are unsecured loans given to individuals for various purposes such as buying a car, consolidating debt, or financing a vacation.

-

Mortgages: These are long-term loans used to purchase real estate. The property itself serves as collateral.

-

Business Loans: These are loans provided to businesses to finance operations, expansion, or capital investments.

-

Credit Cards: These are revolving lines of credit that allow cardholders to borrow money up to a certain limit and pay it back with interest.

3. Providing Credit Facilities

-

Overdraft Facilities: These allow account holders to withdraw more money than they have in their account, up to a pre-approved limit.

-

Lines of Credit: These are flexible loans from a bank that have a set amount of money you can use as needed and pay back either immediately or over time.

4. Facilitating Money Transfers

-

Wire Transfers: These are electronic transfers of money from one bank account to another, often used for large sums or international transactions.

-

Electronic Funds Transfers (EFT): These include direct deposits, online bill payments, and other automated transactions.

-

Checks: These are written instruments that instruct a bank to pay a specific amount of money from the drawer’s account to the payee.

5. Foreign Exchange Services

-

Currency Exchange: Banks provide services to exchange one currency for another, which is essential for international travel and trade.

-

Foreign Currency Accounts: These allow individuals and businesses to hold and manage funds in foreign currencies.

6. Safekeeping of Valuables

7. Issuing Financial Instruments

-

Bank Drafts: These are payment instruments issued by a bank, which guarantees the payment to the payee.

-

Letters of Credit: These are documents issued by banks to guarantee that a payment will be made to a seller, provided certain conditions are met. They are commonly used in international trade.

8. Investment Services

-

Brokerage Services: Some banks offer brokerage services where customers can buy and sell stocks, bonds, and other securities.

-

Wealth Management: Banks provide advisory services to help high-net-worth individuals manage their investments and financial planning.

9. Electronic Banking Services

-

Online Banking: This allows customers to manage their accounts, transfer funds, pay bills, and perform other transactions via the internet.

-

Mobile Banking: Similar to online banking, but accessed through mobile apps, providing even greater convenience.

-

ATM Services: Automated Teller Machines (ATMs) allow customers to withdraw cash, deposit funds, and check account balances at any time.

10. Financial Advice and Consulting

-

Personal Financial Planning: Banks offer advice on budgeting, saving, and investment strategies.

-

Business Consulting: Banks provide financial consulting services to businesses, including cash flow management, financial planning, and risk assessment.

11. Regulatory Compliance and Security

-

Regulation: Banks are heavily regulated to ensure financial stability and protect consumers. They must adhere to strict rules regarding capital reserves, lending practices, and anti-money laundering measures.

-

Security: Banks implement advanced security measures to protect customer data and funds, including encryption, fraud detection systems, and secure authentication methods.

12. Community and Economic Development

-

Supporting Local Businesses: Banks often provide loans and financial services to small businesses, which helps stimulate local economies.

-

Community Programs: Many banks engage in community development initiatives, such as supporting education, housing, and small business development.

What is an NBFC?

An NBFC, on the other hand, is a company registered under the Companies Act that provides banking services without holding a banking license. NBFCs offer services like loans and credit facilities, retirement planning, and hire-purchase finance. They are regulated by the RBI in India and are subject to different rules compared to banks.

NBFCs are regulated by financial authorities such as the Reserve Bank of India (RBI) in India, the Securities and Exchange Board of India (SEBI), and other relevant regulatory bodies. These regulations ensure that NBFCs operate in a transparent and accountable manner, protecting the interests of their clients and maintaining financial stability.

In summary, NBFCs provide a wide array of financial services that complement the offerings of traditional banks, catering to diverse segments of the economy and contributing to overall financial inclusion and economic growth.

Functions of NBFCs

Non-Banking Financial Companies (NBFCs) play a crucial role in the financial ecosystem by providing a wide range of financial services. Here are some of the key functions of NBFCs:

1. Credit Facilities

-

Loans and Advances: NBFCs provide various types of loans such as personal loans, home loans, vehicle loans, and business loans. They cater to segments that may find it difficult to obtain loans from traditional banks.

-

Equipment Financing: They offer financing for the purchase of equipment, machinery, and other capital goods, which is particularly beneficial for small and medium-sized enterprises (SMEs).

2. Investment Services

-

Portfolio Management: NBFCs manage investment portfolios for individuals and businesses, offering services such as asset allocation, risk management, and investment advice.

-

Mutual Funds: Some NBFCs also act as distributors for mutual funds, providing investors with access to a diversified range of investment options.

3. Leasing and Hire Purchase

-

Leasing: NBFCs provide leasing services for various assets, including real estate, vehicles, and equipment. This allows businesses and individuals to use assets without the need for full upfront payment.

-

Hire Purchase: They offer hire purchase schemes, enabling customers to acquire assets by making installment payments over a specified period.

4. Factoring Services

5. Foreign Exchange Services

-

Currency Exchange: NBFCs facilitate foreign exchange transactions, providing services such as currency conversion, remittances, and foreign currency loans. This is particularly useful for businesses engaged in international trade and individuals traveling abroad.

6. Insurance Services

-

Insurance Broking: Many NBFCs act as insurance brokers, helping clients choose the right insurance policies and facilitating the purchase process.

-

Insurance Products: Some NBFCs also offer their own insurance products, providing a comprehensive suite of financial services under one roof.

7. Wealth Management

-

Financial Planning: NBFCs offer wealth management services, including financial planning, retirement planning, and tax planning. They help clients achieve their financial goals by providing customized advice and solutions.

-

High-Net-Worth Services: They cater to high-net-worth individuals, offering exclusive wealth management services and personalized investment strategies.

8. Microfinance

-

Microloans: NBFCs play a significant role in providing microloans to low-income individuals and small businesses. These loans are typically small in amount and are designed to help borrowers start or expand their businesses.

-

Financial Inclusion: They contribute to financial inclusion by reaching out to underserved and unbanked populations, providing them with access to basic financial services.

9. Merchant Banking

-

Corporate Advisory: NBFCs offer merchant banking services, including corporate advisory, mergers and acquisitions, and capital raising. They assist businesses in various financial transactions and strategic planning.

10. Other Services

-

Chit Funds: Some NBFCs operate chit funds, which are a form of savings and lending scheme where members contribute to a pool of funds and take turns receiving the entire amount.

-

Money Transfer Services: NBFCs facilitate domestic and international money transfers, providing a convenient and cost-effective alternative to traditional banking channels.

Features of NBFCs

1. Non-Banking Nature

-

No Banking License: NBFCs do not hold a banking license and are not allowed to accept demand deposits (current or savings accounts) from the public. This is a fundamental distinction from commercial banks.

-

No Legal Tender: They cannot issue currency or demand notes, which is a prerogative of central banks.

2. Diverse Financial Services

-

Wide Range of Products: NBFCs offer a variety of financial products and services, including loans, leasing, factoring, insurance broking, mutual fund distribution, and wealth management.

-

Specialization: Many NBFCs specialize in specific segments such as microfinance, housing finance, or equipment leasing, allowing them to provide tailored solutions to their clients.

3. Regulatory Framework

-

Regulated by Financial Authorities: NBFCs are regulated by financial regulatory bodies such as the Reserve Bank of India (RBI) in India, the Securities and Exchange Board of India (SEBI), and other relevant authorities. These regulations ensure compliance with financial norms and protect consumer interests.

-

Compliance Requirements: They must adhere to capital adequacy norms, liquidity requirements, and other regulatory guidelines to ensure financial stability and transparency.

4. Operational Flexibility

-

Agility and Innovation: NBFCs are generally more agile and innovative compared to traditional banks. They can quickly adapt to market changes and introduce new financial products and services.

-

Technology Adoption: Many NBFCs leverage advanced technology and digital platforms to enhance customer experience, streamline operations, and reduce costs.

5. Customer Focus

-

Targeted Customer Segments: NBFCs often focus on specific customer segments that may be underserved by traditional banks, such as small and medium-sized enterprises (SMEs), micro-entrepreneurs, and low-income individuals.

-

Personalized Services: They provide personalized financial solutions tailored to the unique needs and risk profiles of their clients.

6. Risk Management

-

Diversified Risk Profile: NBFCs manage a diversified portfolio of assets and liabilities, which helps in spreading risk across different sectors and customer segments.

-

Robust Risk Assessment: They employ robust risk assessment and management techniques to evaluate and mitigate credit, market, and operational risks.

7. Funding Sources

-

Multiple Funding Options: NBFCs raise funds from various sources, including equity capital, debt instruments, and borrowings from banks and financial institutions.

-

Commercial Paper and Bonds: They often issue commercial paper and bonds to raise funds from the capital markets, providing them with additional liquidity.

8. Contribution to Financial Inclusion

-

Access to Financial Services: NBFCs play a crucial role in financial inclusion by providing access to financial services to underserved and unbanked populations.

-

Microfinance and SME Support: They offer microloans and other financial services to micro-entrepreneurs and SMEs, helping to boost economic activity at the grassroots level.

9. Corporate Structure

-

Corporate Governance: NBFCs operate under a corporate structure with a board of directors and adhere to corporate governance norms to ensure transparency and accountability.

-

Professional Management: They are managed by professional teams with expertise in various financial domains, ensuring efficient operations and strategic decision-making.

10. Complementary Role to Banks

-

Gap Filling: NBFCs fill the gaps left by traditional banks, providing financial services to segments that banks may find unviable or too risky.

-

Synergy with Banks: They often work in synergy with banks, providing complementary services and contributing to the overall financial ecosystem.

11. Transparency and Accountability

-

Reporting Requirements: NBFCs are required to maintain detailed records and submit regular reports to regulatory authorities, ensuring transparency and accountability.

-

Customer Protection: They are mandated to follow customer protection guidelines, ensuring fair practices and safeguarding consumer interests.

12. Innovative Business Models

-

Fintech Integration: Many NBFCs integrate fintech solutions to enhance their operations, such as using mobile apps for loan applications, digital KYC processes, and automated credit assessments.

-

Collaborative Models: They often collaborate with fintech companies, banks, and other financial institutions to leverage technology and expand their service offerings.

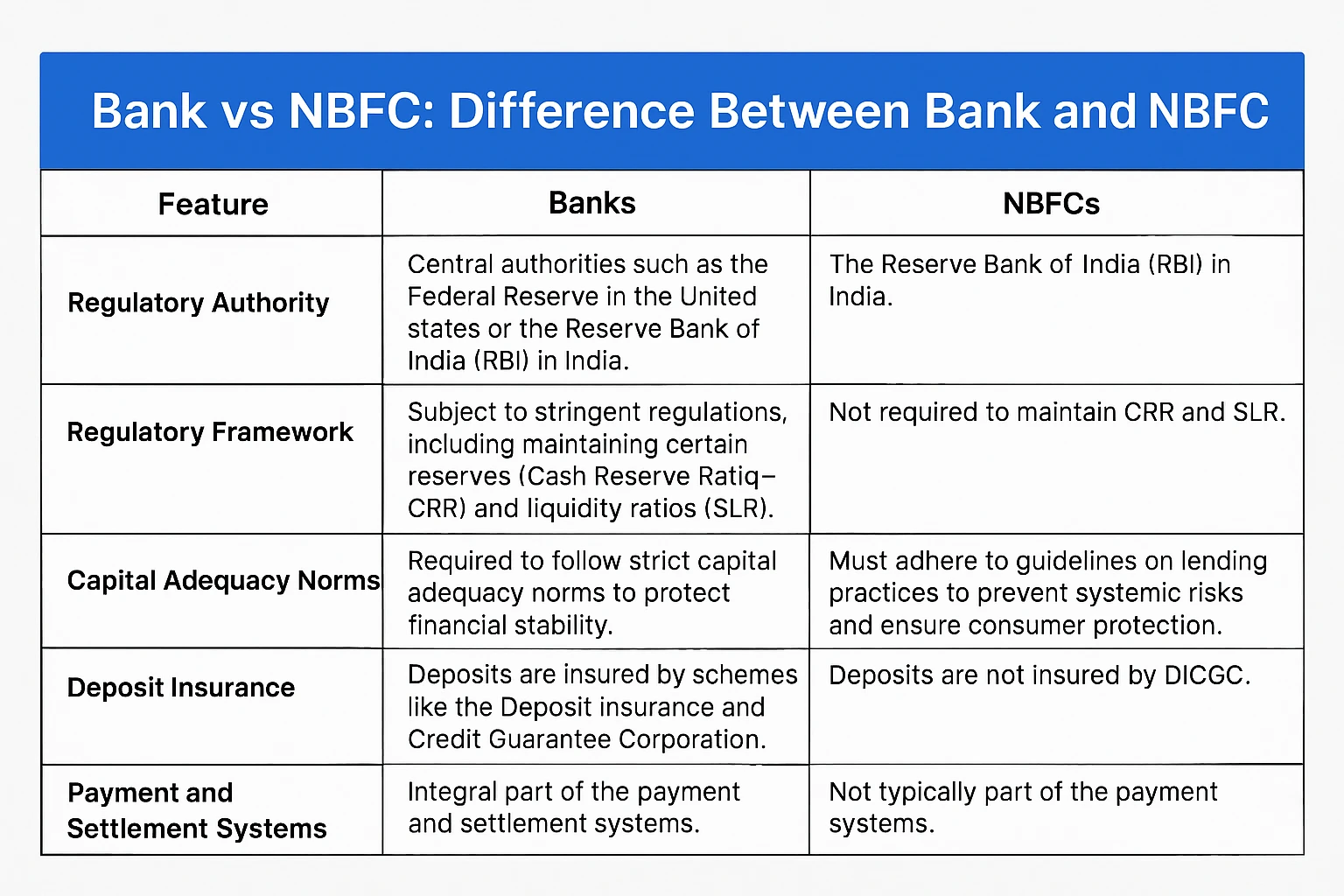

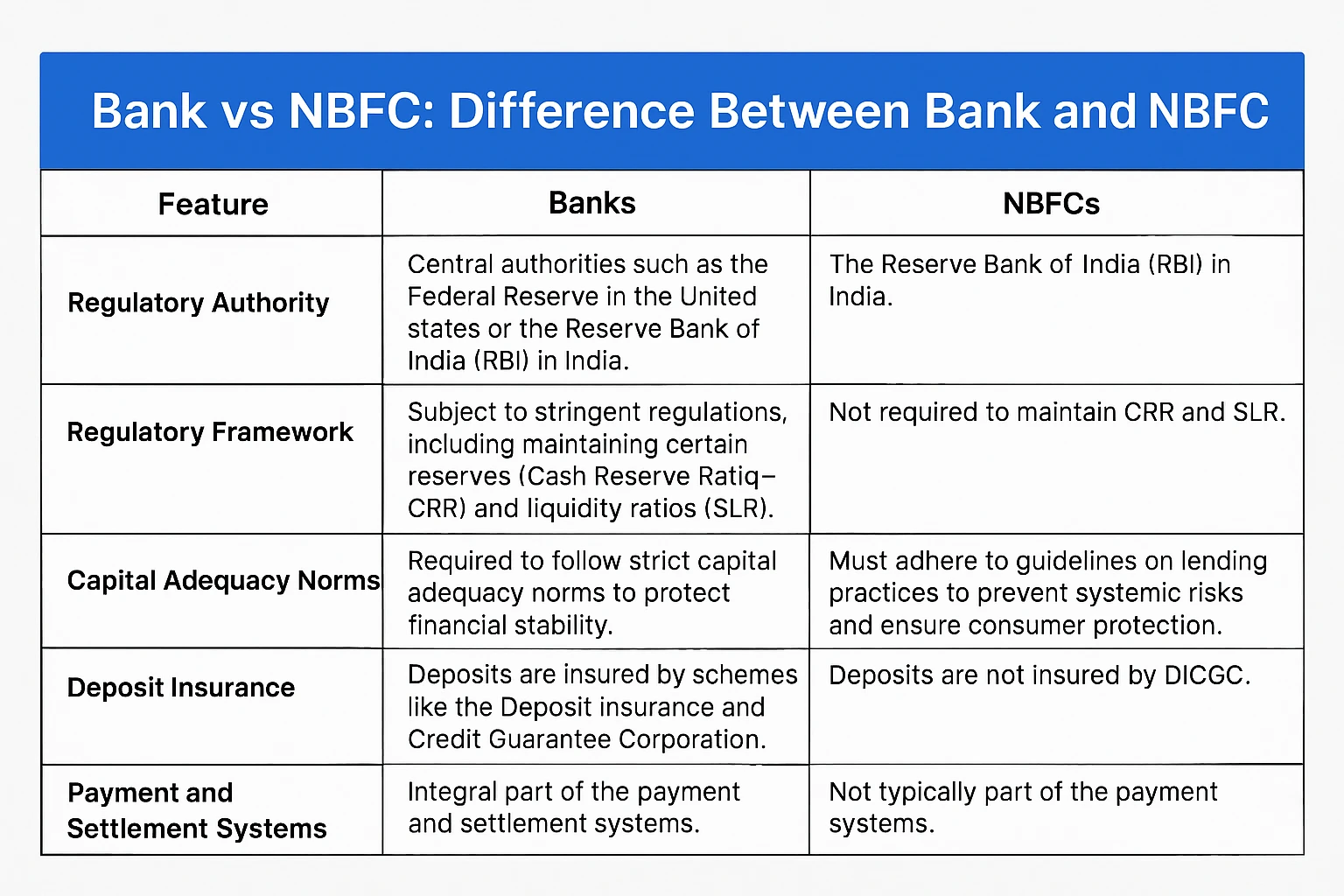

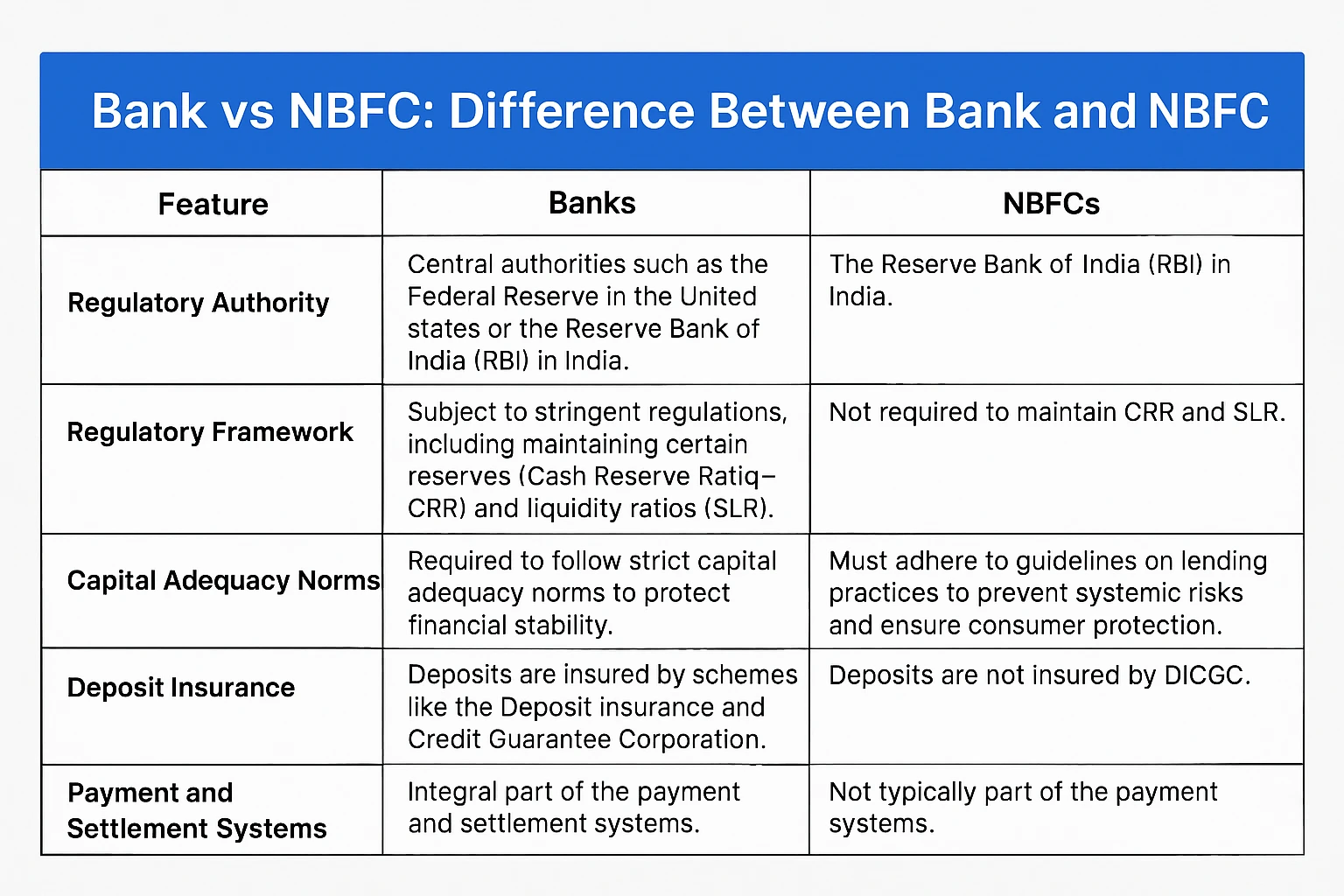

Tabular Comparison – Banks vs NBFCs in India

| Feature |

Banks |

NBFCs |

| Regulatory Authority |

Central authorities such as the Federal Reserve in the United States or the Reserve Bank of India (RBI) in India. |

The Reserve Bank of India (RBI) in India. |

| Regulatory Framework |

Subject to stringent regulations, including maintaining certain reserves (Cash Reserve Ratio – CRR) and liquidity ratios (Statutory Liquidity Ratio – SLR). |

Not required to maintain CRR and SLR. |

| Capital Adequacy Norms |

Required to follow strict capital adequacy norms to protect depositors’ money. |

Subject to capital adequacy norms, but less stringent than those for banks. |

| Lending Practices |

Must adhere to guidelines on lending practices to ensure financial stability. |

Must adhere to guidelines on lending practices to prevent systemic risks and ensure consumer protection. |

| Deposit Insurance |

Deposits are insured by schemes like the Deposit Insurance and Credit Guarantee Corporation (DICGC) in India. |

Deposits are not insured by DICGC. |

| Payment and Settlement Systems |

Integral part of the payment and settlement systems. |

Not typically part of the payment and settlement systems. |

Evolution of Banks vs. NBFCs

1. Historical Background

-

Banks

-

Early Beginnings: Banks have a long history, dating back to the medieval period in Europe. The concept of banking evolved from the need to store and manage money securely.

-

Modern Banking: The modern banking system, as we know it today, began to take shape in the 19th and 20th centuries with the establishment of central banks and regulatory frameworks to oversee financial institutions.

-

NBFCs

-

Emergence: Non-Banking Financial Companies (NBFCs) emerged in the 20th century as a response to the limitations of traditional banking. They were designed to provide financial services to segments of the population that traditional banks were not serving adequately.

-

Growth: The growth of NBFCs accelerated in the latter half of the 20th century, particularly in the United States and India, where they played a crucial role in providing credit to small businesses and individuals.

2. Regulatory Evolution

-

Banks

-

Stringent Regulation: Banks have always been subject to strict regulatory oversight. In India, they are regulated by the Reserve Bank of India (RBI) under the Banking Regulation Act, 1949. This includes requirements for maintaining cash reserves, statutory liquidity ratios, and capital adequacy.

-

Post-Crisis Reforms: After the 2008 financial crisis, regulations for banks became even more stringent globally to prevent systemic risks and ensure financial stability.

-

NBFCs

-

Less Regulation: NBFCs are regulated by the RBI but under a less stringent framework compared to banks. They are not required to maintain cash reserves or statutory liquidity ratios.

-

Regulatory Arbitrage: The regulatory differences have sometimes led to “regulatory arbitrage,” where NBFCs can operate with more flexibility than banks.

-

Recent Changes: In recent years, the regulatory framework for NBFCs has evolved to address concerns about systemic risks. For example, the RBI has introduced stricter norms for NBFCs, especially those with significant exposure to risky assets.

3. Services Offered

-

Banks

-

Diverse Services: Banks offer a wide range of services, including savings and current accounts, fixed deposits, loans, credit cards, and investment services. They are also integral to the payment and settlement systems, issuing cheques and demand drafts.

-

Deposit Insurance: Deposits in banks are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC) up to ₹5 lakh per depositor per bank.

-

NBFCs

-

Specialized Services: NBFCs primarily focus on lending and investment services. They offer loans for personal needs, businesses, vehicles, and housing. They also provide investment options such as mutual funds and insurance.

-

No Deposit Insurance: Deposits in NBFCs are not insured by the DICGC.

4. Loan Approval Process

-

Banks

-

Structured Process: Banks follow a structured and often lengthy loan approval process. They require extensive documentation and a high credit score. The process can take up to 30 working days.

-

NBFCs

5. Interest Rates

6. Risk Profile

7. Role in the Financial System

-

Banks

-

Core of Financial System: Banks are at the core of the financial system. They play a crucial role in money supply, payment systems, and financial stability.

-

NBFCs

-

Complementary Role: NBFCs complement the banking system by providing credit to segments that banks find difficult to serve. They also promote financial inclusion by reaching out to underserved areas.

Frequently Asked Questions (FAQs) about Banks and Non-Banking Financial Companies (NBFCs)

1. Can NBFCs accept deposits like banks?

Ans: NBFCs can accept time deposits under certain conditions, but they cannot accept demand deposits like banks. This is a significant limitation as demand deposits form a crucial part of a bank’s liquidity. The regulations for NBFCs regarding deposit acceptance are more restrictive to prevent them from becoming too similar to banks and to protect the financial system from potential risks.

2. Are NBFCs regulated by the same authority as banks?

Ans: In India, both banks and NBFCs are regulated by the Reserve Bank of India (RBI), but they operate under different regulations. Banks are subject to stricter regulations, including maintaining cash reserves and liquidity ratios, which NBFCs are not required to follow. This difference in regulation allows NBFCs more flexibility in their operations but also means they are not subject to the same liquidity requirements as banks.

3. What are the primary services offered by NBFCs?

Ans: NBFCs primarily offer services like loans and credit facilities, hire-purchase finance, and consumer finance. They often focus on specific segments of the market, such as consumer durables, infrastructure finance, and microfinance. This specialization allows NBFCs to provide more tailored and flexible lending solutions, which can be particularly beneficial for segments that banks may not serve effectively.

4. Why are NBFCs important in the financial ecosystem?

Ans: NBFCs play a crucial role in providing financial services to segments that banks may not reach effectively. They offer specialized services and can sometimes provide more flexible lending terms, making them an essential part of the financial ecosystem. For example, NBFCs can provide loans to small and medium enterprises (SMEs) or finance specific industries, thereby supporting economic growth and financial inclusion.

5. Are deposits with NBFCs insured like bank deposits?

Ans: No, deposits with NBFCs are not insured by schemes like the Deposit Insurance and Credit Guarantee Corporation (DICGC) in India. This means that depositors with NBFCs do not have the same level of protection as those with banks. This is a significant risk for depositors, and they should be aware of this difference when choosing where to deposit their funds.

6. Can both banks and NBFCs provide loans?

Ans: Yes, both banks and NBFCs can provide loans. However, banks have broader authority to offer various types of loans, while NBFCs typically focus on specific types of lending, such as consumer loans or asset financing.

Conclusion:

Understanding the differences between banks and NBFCs is crucial for anyone looking to make informed financial decisions. While banks offer a wide range of services and are subject to strict regulations, NBFCs specialize in specific financial services and operate under different rules. Both institutions play vital roles in the financial ecosystem, but their unique characteristics mean they cater to different needs.

For those seeking comprehensive financial services, including savings accounts and payment systems, banks are the go-to option. However, for specialized lending and credit facilities, NBFCs can be a valuable alternative. As always, it’s essential to research and understand the regulations and protections associated with each institution before making any financial commitments.