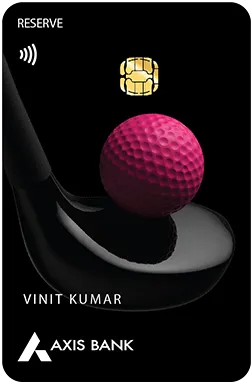

Axis Reserve Credit Card

Axis Bank

last updated: Nov 12, 2025

₹50,000

₹50,000

1.5%

No lounge access

Contents

Axis Reserve Credit Card is a super-premium Visa credit card designed for high-end users and frequent travellers. It offers unlimited domestic and international airport lounge access, complimentary memberships with luxury hotel chains, and high rewards on spending. Additional benefits include golf privileges and exclusive dining offers.

Features of Axis Reserve Credit Card which makes it unique

Unlimited Golf Rounds

50 complimentary rounds annually

Premium leisure benefits

Higher than most premium cards

Luxury Hotel Memberships

Complimentary ITC, AccorPlus and Marriott memberships

Exclusive benefits and discounts

Valuable for frequent travellers

Rewards Structure of Axis Reserve Credit Card

Draining

baseSelected restaurants

Includes exclusive dining memberships

Treval

baseFlight and hotel bookings

Including MakeMyTrip and Yatra bookings

:

International Spend

acceleratedAll international transactions

2X reward points on international spends

Base

baseAll other spends

Standard earning on other transactions

Milestones of Axis Reserve Credit Card

Annual Spend Milestone

₹35,00,000 : Annual fee waiver

First Transaction

Any amount : 15,000 Edge Reward Points

Fees & Charges of Axis Reserve Credit Card

| Fee & Amount | Fee Value |

|---|---|

| Joining Fee | ₹50,000 |

| Annual Fee | ₹50,000 |

| Forex Markup Fee | 1.5% |

| Cash Advance Fee | 3% |

| Late Payment Fee | ₹750 |

| Over Limit Fee | ₹500 |

| Returned Payment Fee | ₹350 |

| Cash Withdrawal Fee | 0% |

Renewal Conditions:Waived on ₹35,00,000 annual spend

Fee Explanation Standard bank rates apply for overdue amounts.

Lounge Access Benefits with Axis Reserve Credit Card

domestic Lounges

silverVisits per year: 0

Guest access: Yes

Priority Pass membership included

international Lounges

silverVisits per year: 0

Guest access: Yes

Priority Pass membership included with 12 guest visits annually

Insurance Coverage with Axis Reserve Credit Card

travel insurance

₹20,00,000Valid globally on international trips

purchase protection

₹2,00,000Valid up to 90 days from purchase

lost card liability

Up to credit limitAgainst lost or stolen card

Additional Features of Axis Reserve Credit Card

Contactless Payments

Enabled for tap and pay

Add-on Cards

Up to 3 free add-on cards

Concierge Services

24x7 personal assistance

Welcome Bonus with Axis Reserve Credit Card

Welcome Bonus: 15,000 Edge Reward Points on first transaction

Bonus Conditions: First transaction must be within 30 days of card activation

Application Process for Axis Reserve Credit Card

Processing Time

7 business days

Online Application

Available

Instant Approval

Not Available

Step-by-Step Process

Apply online via Axis Bank official portal or Finanjo

Upload KYC and income documents

Receive verification call from the bank

Card dispatched within 7 business days

Required Documents for Axis Reserve Credit Card

ID Proof

allAccepted documents:

Address Proof

allAccepted documents:

Income Proof

salariedAccepted documents:

Income Proof

self-employedAccepted documents:

Axis Reserve Credit Card Merchant Acceptance Network

Domestic Acceptance

Wide coverage across India

International Acceptance

Accepted globally

Online Acceptance

Yes

Payment Technologies

Mobile Wallet Support:

Excluded Merchants

Eligibility Criteria for Axis Reserve Credit Card

Quick Eligibility Check

Minimum Age

25+

Credit Score

750+

Citizenship

Indian only

Income Requirements

Salaried Applicants

₹100,000

Minimum annual income

Self-Employed Applicants

₹150,000

Minimum annual income

Who Can Apply

Important Conditions

- Valid PAN and Aadhaar card required.

How Approval Is Decided

- Minimum income ₹1,00,000/month

- Indian residency

- Credit score above 750

Pros of Axis Reserve Credit Card

- Premium travel and leisure benefits

- High accelerated rewards with 2X on international spends

- Complimentary hotel memberships and golf rounds

Cons of Axis Reserve Credit Card

- High joining and annual fees

- High income requirement

- Limited rewards on utility and government spends

Frequently Asked Questions about Axis Reserve Credit Card

What is the joining fee for Axis Reserve Credit Card?

The joining fee is ₹50,000 plus applicable taxes.

Is the annual fee waiver available?

Yes, the annual fee is waived on an annual spend of ₹35 lakhs.

What rewards can I earn on international spends?

You earn 2X Edge Reward Points on all international spends.

How many lounge visits are allowed?

Unlimited domestic and international lounge access with 12 free guest visits a year.

Are add-on cards free?

Yes, up to 3 add-on cards are free of charge.

Add Your Review

Reviews (0)

No reviews yet

Be the first one to review this card.