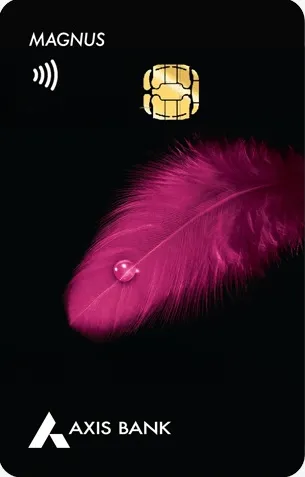

Axis Burgundy Magnus Credit Card

Axis Bank

last updated: Nov 11, 2025

₹30,000

₹30,000

2%

No lounge access

Contents

Axis Burgundy Magnus Credit Card is designed exclusively for high-net-worth individuals with premium benefits including accelerated rewards, unlimited lounge access, and extensive travel privileges. This Mastercard offers great value with multiple airline and hotel partners, making it ideal for luxury lifestyle and travel enthusiasts. Enjoy personalized concierge services, exclusive cashback milestones, and comprehensive insurance coverage.

Features of Axis Burgundy Magnus Credit Card which makes it unique

Accelerated EDGE Rewards

Earn 35 EDGE points per ₹200 on spends above ₹1.5 lakh per month

Maximize reward earnings on high spends

Better than regular Magnus card

Airport Meet & Greet

4 complimentary meet & greet service per year

Seamless airport experience

Exclusive for Burgundy customers

Rewards Structure of Axis Burgundy Magnus Credit Card

Regular Spend

baseAll retail purchases

Earn consistent points on all spends

Accelerated Spend

acceleratedSpends above ₹1.5L/month

Accelerated points beyond high spend threshold

Milestones of Axis Burgundy Magnus Credit Card

Quarterly Spend Milestone

₹7,50,000 : ₹7,500 cashback

Annual Spend Milestone

₹3,00,00,000 : Complimentary luxury vacation package

Fees & Charges of Axis Burgundy Magnus Credit Card

| Fee & Amount | Fee Value |

|---|---|

| Joining Fee | ₹30,000 |

| Annual Fee | ₹30,000 |

| Forex Markup Fee | 2% |

| Cash Advance Fee | 3% |

| Late Payment Fee | ₹1,000 |

| Over Limit Fee | ₹500 |

| Returned Payment Fee | ₹350 |

| Cash Withdrawal Fee | 3% |

Renewal Conditions:Waived on ₹25 lakh annual spend excluding rent, wallet, government services, insurance, fuel, gold/jewellery, and utilities

Fee Explanation Standard bank rates apply for overdue amounts.

Lounge Access Benefits with Axis Burgundy Magnus Credit Card

domestic Lounges

platinumVisits per year: 0

Guest access: Yes

For primary cardholder and guests

international Lounges

platinumVisits per year: 0

Guest access: Yes

Through Priority Pass

Insurance Coverage with Axis Burgundy Magnus Credit Card

Travel Insurance

₹15,00,000Valid on international trips

Purchase Protection

₹75,000Within 90 days of purchase

Additional Features of Axis Burgundy Magnus Credit Card

Contactless Payments

Enabled for tap-and-pay convenience

No Add-on Cards

Add-on cards not available for Magnus Burgundy

Welcome Bonus with Axis Burgundy Magnus Credit Card

Welcome Bonus: 5,000 Luxe gift voucher

Bonus Conditions: Welcome voucher from Luxe, Postcard Hotels, or Yatra

Application Process for Axis Burgundy Magnus Credit Card

Processing Time

7-10 business days

Online Application

Available

Instant Approval

Not Available

Step-by-Step Process

Apply online via Axis Bank portal

Upload KYC and income documents

Verification and approval process

Card dispatched within 10 business days

Required Documents for Axis Burgundy Magnus Credit Card

ID Proof

allAccepted documents:

Address Proof

allAccepted documents:

Income Proof

salariedAccepted documents:

Axis Burgundy Magnus Credit Card Merchant Acceptance Network

Domestic Acceptance

Wide coverage across India

International Acceptance

Accepted globally

Online Acceptance

Yes

Payment Technologies

Mobile Wallet Support:

Excluded Merchants

Eligibility Criteria for Axis Burgundy Magnus Credit Card

Quick Eligibility Check

Minimum Age

25+

Credit Score

750+

Citizenship

Indian only

Income Requirements

Salaried Applicants

₹300,000

Minimum annual income

Self-Employed Applicants

₹500,000

Minimum annual income

Who Can Apply

Important Conditions

- Must be an Axis Burgundy relationship customer with required financial thresholds.

How Approval Is Decided

- Minimum income ₹3,00,000/month

- Axis Burgundy relationship client

- Credit score above 750

Pros of Axis Burgundy Magnus Credit Card

- High accelerating rewards on luxury spends

- Comprehensive travel and insurance benefits

- Exclusive access for Axis Burgundy clients

Cons of Axis Burgundy Magnus Credit Card

- High joining and annual fees

- Add-on cards not allowed

- Strict eligibility criteria

Frequently Asked Questions about Axis Burgundy Magnus Credit Card

What is the joining fee for Axis Burgundy Magnus Credit Card?

The joining fee is ₹30,000 plus applicable GST.

Is there an annual fee waiver available?

Yes, annual fee is waived on ₹25 lakh annual spend excluding select categories.

Are add-on cards available with this card?

No, add-on cards are not available for Axis Burgundy Magnus Credit Card.

How can I redeem my EDGE reward points?

Points can be redeemed via Axis EDGE Rewards portal for products, gift vouchers, and air miles transfer.

What lounge access benefits are included?

Unlimited domestic and international lounge access with guest privileges through Priority Pass.

Add Your Review

Reviews (0)

No reviews yet

Be the first one to review this card.