Do you know the single most important number that can decide whether your dream home, car, or credit card gets approved?

It’s your credit score a powerful 3-digit number that reflects your financial discipline and creditworthiness.

In India, your credit score ranges from 300 to 900, and the higher it is, the more trustworthy you appear to lenders. A high credit score not only increases your chances of loan approval and credit card eligibility but also helps you secure better interest rates and faster approvals.

Your credit score isn’t random, it’s built from your repayment history, outstanding debts, credit utilization ratio, and credit mix. Every time you borrow or pay back money, it’s recorded by one of India’s major credit bureaus CIBIL (TransUnion), Experian, Equifax, and CRIF High Mark. These institutions collect your credit information and calculate your score, helping banks and financial institutions assess your financial reliability.

Whether you’re planning to apply for a home loan, personal loan, or new credit card, remember your CIBIL score can be the deciding factor between instant approval and rejection.

Your credit score whether it’s from CIBIL, Experian, Equifax, or CRIF High Mark is more than just a number. It’s a snapshot of your financial health and plays a major role in deciding whether you’ll get approved for a loan, credit card, or mortgage and at what interest rate.

Here’s a detailed breakdown of the credit score range in India and what each level means for your creditworthiness and loan approval chances

| Credit Score Range (300–900) | Category | Significance & Approval Chances |

|---|---|---|

| 800 – 900 | Excellent / Exceptional | Reflects a near-perfect repayment history. Eligible for the lowest interest rates, highest credit limits, and quick approvals. |

| 750 – 799 | Very Good | Ideal range showing responsible financial behaviour. Lenders view you as low-risk, making it easy to get home loans, personal loans, or credit cards on favourable terms. |

| 650 – 749 | Good | Acceptable score but not premium. You can still get approved for loans or credit cards, though interest rates may be slightly higher. |

| 550 – 649 | Fair / Average | Considered a risky borrower. Approvals may require collateral or a co-applicant, and interest rates will likely be higher. |

| 300 – 549 | Poor / Low | Signals defaults or late payments. Very low chances of approval, credit repair and consistent repayments are needed to rebuild trust. |

| Below 300 / NA / NH | No Credit History | You may be new to credit or haven’t had recent activity. Lenders find it hard to assess your risk, start with a secured credit card or small personal loan to build your score. |

Tip: A score of 750+ is considered strong for quick loan approvals and better credit card offers.

A credit score of 750 or above is considered excellent in India, it opens the door to better loan offers, higher credit card limits, and quicker approvals.

Your CIBIL score isn’t just a number, it’s your financial reputation. Keep it strong by paying bills on time, maintaining low credit utilization, and checking your credit report regularly for errors.

Your credit score is more than just a number, it’s your financial passport. Whether you’re applying for a home loan, car loan, personal loan, or credit card, lenders use your CIBIL score as the first filter to decide if you’re a trustworthy borrower.

But that’s not where it stops. Your credit score in India can also influence other areas of your financial life:

A higher credit score means you’re seen as a low-risk borrower, which helps you secure better interest rates, higher credit limits, and faster approvals. Even a 1% reduction in interest rate on a long-term loan can save you lakhs of rupees over time, making your credit score one of the most valuable assets in your financial toolkit.

So, if you’ve been ignoring your CIBIL score, now’s the time to check, monitor, and improve it, because your next big financial opportunity could depend on it.

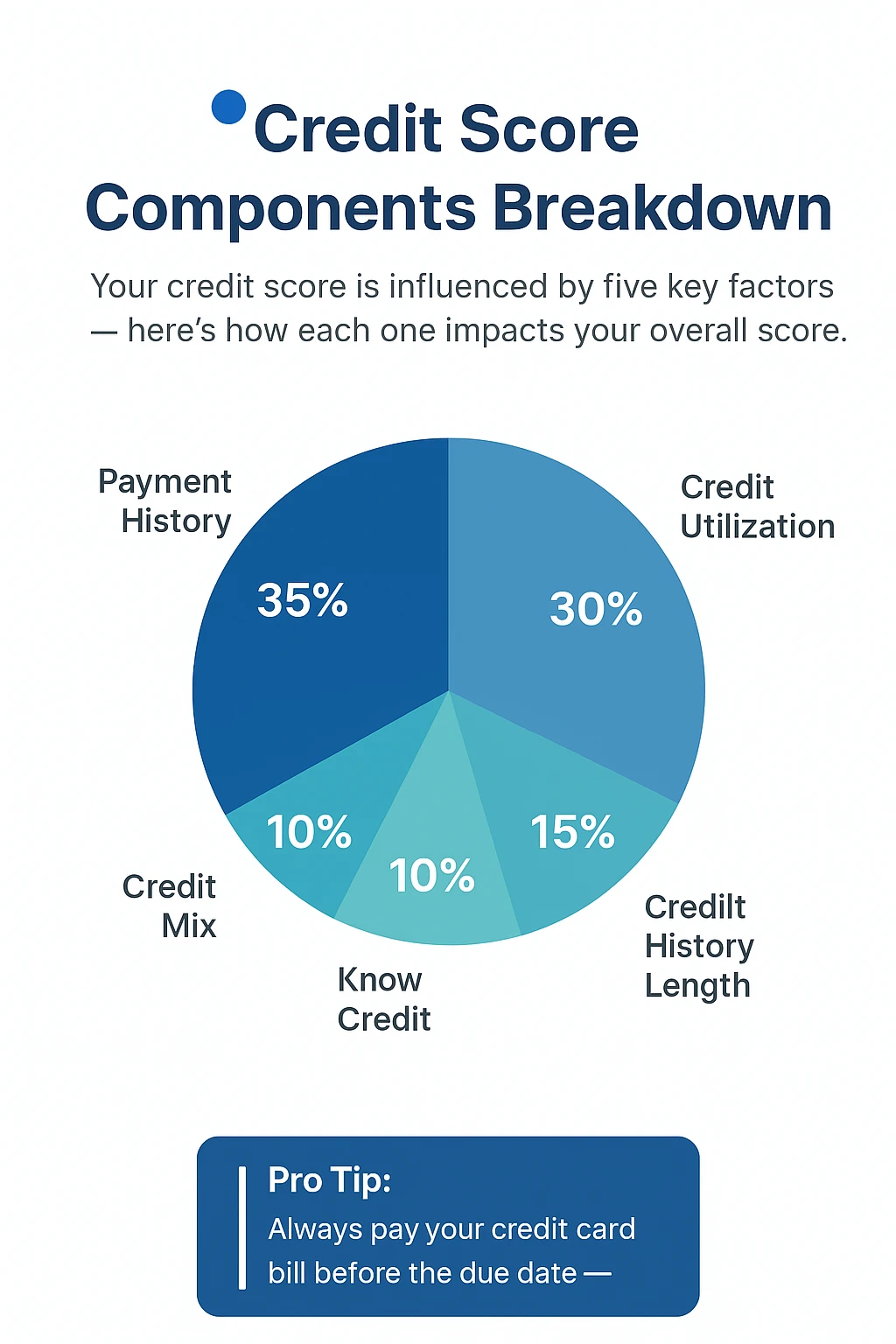

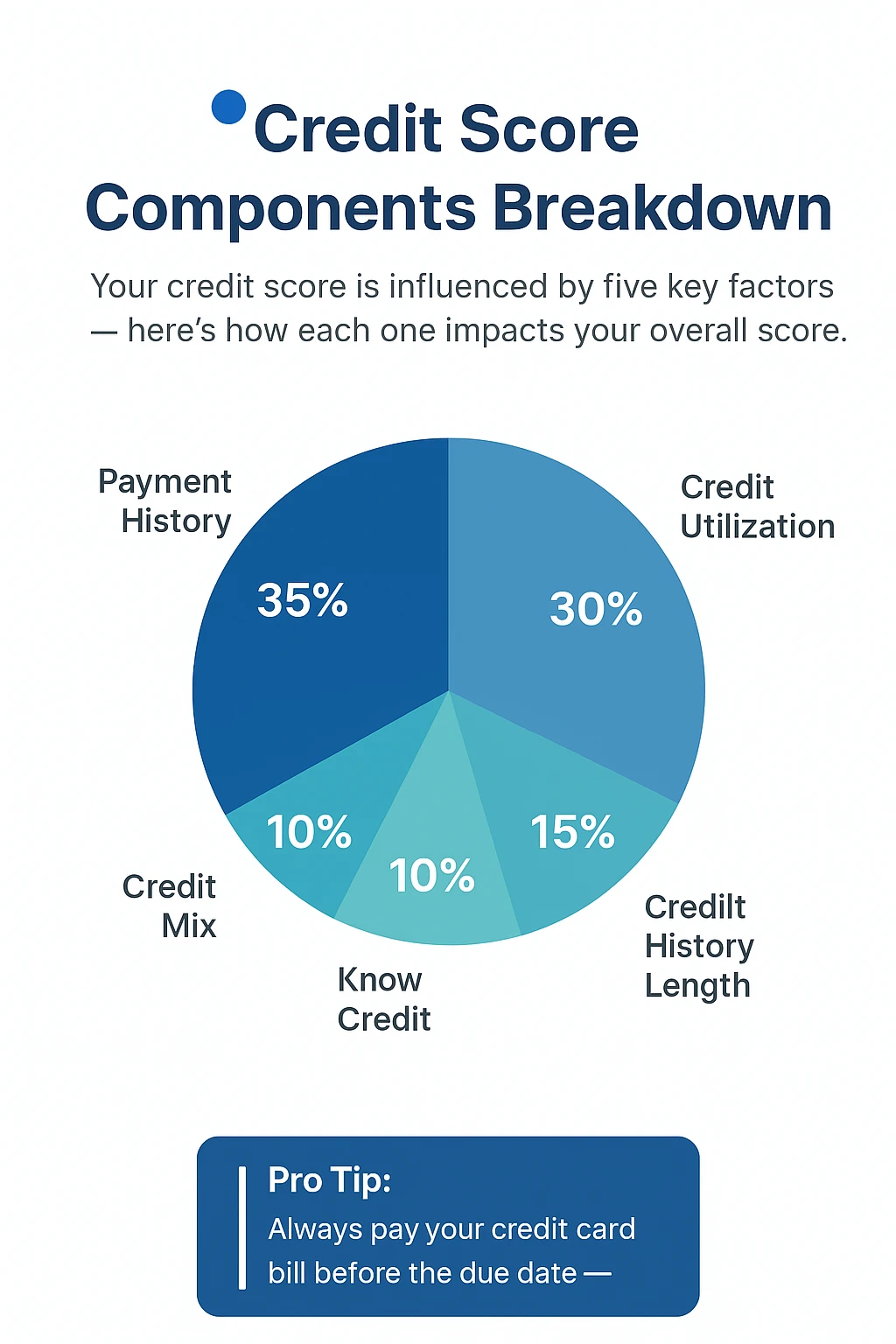

Ever wondered how your credit score (CIBIL score) is actually calculated?

It’s based on data from your credit report, analyzed across five key factors, each with its own weightage. These “pillars” reflect your borrowing and repayment behavior, helping lenders assess your creditworthiness.

Here’s a breakdown of the five major factors that influence your credit score in India

| Factor | Weightage | Good Practice ✅ | Bad Practice ❌ |

|---|---|---|---|

| Payment History | 35% | Pay all EMIs and credit card bills on time. | Late payments, loan defaults, or settlements lower your score significantly. |

| Credit Utilisation Ratio (CUR) | 30% | Keep credit card usage below 30% of total limit. | Maxing out cards or revolving high balances. |

| Length of Credit History | 15% | Maintain old credit accounts and consistent repayment history. | Closing old accounts or having only new credit lines. |

| New Credit / Hard Enquiries | 10% | Apply for new loans or cards only when needed. | Submitting multiple applications within a short period. |

| Credit Mix | 10% | Maintain a healthy mix of secured (home/car) and unsecured (credit/personal) loans. | Relying only on unsecured loans or lacking variety. |

Tip: Set up auto-pay and keep utilisation under 30% to steadily improve your score.

| 💭 Common Credit Score Myths | ✅ The Actual Facts |

|---|---|

| Checking your CIBIL score reduces it. | Soft inquiries like checking your own score don’t affect it at all. Only hard inquiries (from lenders) can temporarily reduce it. |

| Closing old credit cards improves your score. | It actually reduces your credit age and can hurt your score, as older accounts show long-term repayment consistency. |

| Having no loans means a perfect score. | Without any credit history, bureaus can’t assess your reliability. Build your profile with a secured credit card or small personal loan. |

Tip: Regularly check your CIBIL score — it’s safe and helps you track your financial health.

If your total credit limit is ₹1,00,000, try to keep your monthly spending below ₹30,000 — ideally in the 10–20% range.

Maintaining a low credit utilization ratio signals strong financial discipline and can boost your CIBIL score over time.

Your payment history and credit utilization together make up 65% of your credit score, making them the most crucial factors. Consistent on-time payments, low usage, and a healthy mix of credit types can help you achieve and maintain a CIBIL score above 750, unlocking better loan offers and interest rates.

A high credit score especially a CIBIL score above 750 can be your ticket to instant loan approvals, low interest rates, and premium credit card offers.

But building and maintaining that score takes consistent financial discipline.

Here’s a quick guide to the most effective steps to improve and maintain your credit score

If you spend frequently on your credit card, try to make payments multiple times a month instead of just once.

This keeps your Credit Utilization Ratio (CUR) low in real-time a powerful hack for improving your score faster.

1. What is the credit score range in India?

In India, credit scores generally range from 300 to 900. A higher score reflects better creditworthiness, while a lower score indicates higher risk to lenders.

2. What is considered a good credit score in India?

A credit score of 750 or above is considered good. It helps you get faster loan approvals, lower interest rates, and premium credit card offers.

3. What does a 300–549 credit score mean?

A score in this range is poor and usually signals late payments or defaults. Most lenders will likely reject your loan or credit card applications until the score improves.

4. Is a 650 credit score enough for a personal loan?

It’s average — you might still get a loan, but the interest rate will be higher. Improving your score to 750+ can unlock much better offers.

5. What does a 700 credit score mean for home loan approval?

A score around 700 is fair to good, meaning some banks may approve your home loan, but not at the lowest interest rates. A higher score gives you more negotiation power.

6. How rare is a credit score above 850 in India?

It’s relatively uncommon only a small percentage of borrowers maintain such scores. A score of 850–900 reflects exceptional credit discipline and repayment consistency.

7. What happens if my credit score is 0 or “NA/NH”?

This means you have no credit history yet — you haven’t taken any loans or used a credit card. Starting with a secured credit card can help build your score.

8. Can I go from a 600 to 800 credit score?

Yes, absolutely. By paying all EMIs on time, reducing credit card utilization below 30%, and maintaining accounts responsibly for 6–12 months, you can reach 800+.

9. What’s the average credit score in India?

Most active borrowers in India have a score between 700 and 750, which is considered good enough for general loan approvals and credit card eligibility.

10. Does having a 900 credit score make a difference from 800?

Both are excellent, but a 900 score may get you exclusive loan offers and the lowest possible interest rates it’s like having a perfect financial report card.

A strong credit score isn’t built overnight it’s the result of steady, responsible financial habits.

If you can consistently maintain a CIBIL score of 750 or higher, you’ll enjoy:

Take the first step today: Check your credit score online for free, review your CIBIL report, and start taking small, smart steps to build your financial future with confidence.

A contributor to the Finanjo blog, where I share insightful and easy-to-understand content focused on educating readers about finance. With a clear and approachable writing style, I simplify complex topics to make them more understandable.

Do you know the single most important number that can decide whether your dream home, car, or credit card gets approved?

It’s your credit score a powerful 3-digit number that reflects your financial discipline and creditworthiness.

In India, your credit score ranges from 300 to 900, and the higher it is, the more trustworthy you appear to lenders. A high credit score not only increases your chances of loan approval and credit card eligibility but also helps you secure better interest rates and faster approvals.

Your credit score isn’t random, it’s built from your repayment history, outstanding debts, credit utilization ratio, and credit mix. Every time you borrow or pay back money, it’s recorded by one of India’s major credit bureaus CIBIL (TransUnion), Experian, Equifax, and CRIF High Mark. These institutions collect your credit information and calculate your score, helping banks and financial institutions assess your financial reliability.

Whether you’re planning to apply for a home loan, personal loan, or new credit card, remember your CIBIL score can be the deciding factor between instant approval and rejection.

Your credit score whether it’s from CIBIL, Experian, Equifax, or CRIF High Mark is more than just a number. It’s a snapshot of your financial health and plays a major role in deciding whether you’ll get approved for a loan, credit card, or mortgage and at what interest rate.

Here’s a detailed breakdown of the credit score range in India and what each level means for your creditworthiness and loan approval chances

| Credit Score Range (300–900) | Category | Significance & Approval Chances |

|---|---|---|

| 800 – 900 | Excellent / Exceptional | Reflects a near-perfect repayment history. Eligible for the lowest interest rates, highest credit limits, and quick approvals. |

| 750 – 799 | Very Good | Ideal range showing responsible financial behaviour. Lenders view you as low-risk, making it easy to get home loans, personal loans, or credit cards on favourable terms. |

| 650 – 749 | Good | Acceptable score but not premium. You can still get approved for loans or credit cards, though interest rates may be slightly higher. |

| 550 – 649 | Fair / Average | Considered a risky borrower. Approvals may require collateral or a co-applicant, and interest rates will likely be higher. |

| 300 – 549 | Poor / Low | Signals defaults or late payments. Very low chances of approval, credit repair and consistent repayments are needed to rebuild trust. |

| Below 300 / NA / NH | No Credit History | You may be new to credit or haven’t had recent activity. Lenders find it hard to assess your risk, start with a secured credit card or small personal loan to build your score. |

Tip: A score of 750+ is considered strong for quick loan approvals and better credit card offers.

A credit score of 750 or above is considered excellent in India, it opens the door to better loan offers, higher credit card limits, and quicker approvals.

Your CIBIL score isn’t just a number, it’s your financial reputation. Keep it strong by paying bills on time, maintaining low credit utilization, and checking your credit report regularly for errors.

Your credit score is more than just a number, it’s your financial passport. Whether you’re applying for a home loan, car loan, personal loan, or credit card, lenders use your CIBIL score as the first filter to decide if you’re a trustworthy borrower.

But that’s not where it stops. Your credit score in India can also influence other areas of your financial life:

A higher credit score means you’re seen as a low-risk borrower, which helps you secure better interest rates, higher credit limits, and faster approvals. Even a 1% reduction in interest rate on a long-term loan can save you lakhs of rupees over time, making your credit score one of the most valuable assets in your financial toolkit.

So, if you’ve been ignoring your CIBIL score, now’s the time to check, monitor, and improve it, because your next big financial opportunity could depend on it.

Ever wondered how your credit score (CIBIL score) is actually calculated?

It’s based on data from your credit report, analyzed across five key factors, each with its own weightage. These “pillars” reflect your borrowing and repayment behavior, helping lenders assess your creditworthiness.

Here’s a breakdown of the five major factors that influence your credit score in India

| Factor | Weightage | Good Practice ✅ | Bad Practice ❌ |

|---|---|---|---|

| Payment History | 35% | Pay all EMIs and credit card bills on time. | Late payments, loan defaults, or settlements lower your score significantly. |

| Credit Utilisation Ratio (CUR) | 30% | Keep credit card usage below 30% of total limit. | Maxing out cards or revolving high balances. |

| Length of Credit History | 15% | Maintain old credit accounts and consistent repayment history. | Closing old accounts or having only new credit lines. |

| New Credit / Hard Enquiries | 10% | Apply for new loans or cards only when needed. | Submitting multiple applications within a short period. |

| Credit Mix | 10% | Maintain a healthy mix of secured (home/car) and unsecured (credit/personal) loans. | Relying only on unsecured loans or lacking variety. |

Tip: Set up auto-pay and keep utilisation under 30% to steadily improve your score.

| 💭 Common Credit Score Myths | ✅ The Actual Facts |

|---|---|

| Checking your CIBIL score reduces it. | Soft inquiries like checking your own score don’t affect it at all. Only hard inquiries (from lenders) can temporarily reduce it. |

| Closing old credit cards improves your score. | It actually reduces your credit age and can hurt your score, as older accounts show long-term repayment consistency. |

| Having no loans means a perfect score. | Without any credit history, bureaus can’t assess your reliability. Build your profile with a secured credit card or small personal loan. |

Tip: Regularly check your CIBIL score — it’s safe and helps you track your financial health.

If your total credit limit is ₹1,00,000, try to keep your monthly spending below ₹30,000 — ideally in the 10–20% range.

Maintaining a low credit utilization ratio signals strong financial discipline and can boost your CIBIL score over time.

Your payment history and credit utilization together make up 65% of your credit score, making them the most crucial factors. Consistent on-time payments, low usage, and a healthy mix of credit types can help you achieve and maintain a CIBIL score above 750, unlocking better loan offers and interest rates.

A high credit score especially a CIBIL score above 750 can be your ticket to instant loan approvals, low interest rates, and premium credit card offers.

But building and maintaining that score takes consistent financial discipline.

Here’s a quick guide to the most effective steps to improve and maintain your credit score

If you spend frequently on your credit card, try to make payments multiple times a month instead of just once.

This keeps your Credit Utilization Ratio (CUR) low in real-time a powerful hack for improving your score faster.

1. What is the credit score range in India?

In India, credit scores generally range from 300 to 900. A higher score reflects better creditworthiness, while a lower score indicates higher risk to lenders.

2. What is considered a good credit score in India?

A credit score of 750 or above is considered good. It helps you get faster loan approvals, lower interest rates, and premium credit card offers.

3. What does a 300–549 credit score mean?

A score in this range is poor and usually signals late payments or defaults. Most lenders will likely reject your loan or credit card applications until the score improves.

4. Is a 650 credit score enough for a personal loan?

It’s average — you might still get a loan, but the interest rate will be higher. Improving your score to 750+ can unlock much better offers.

5. What does a 700 credit score mean for home loan approval?

A score around 700 is fair to good, meaning some banks may approve your home loan, but not at the lowest interest rates. A higher score gives you more negotiation power.

6. How rare is a credit score above 850 in India?

It’s relatively uncommon only a small percentage of borrowers maintain such scores. A score of 850–900 reflects exceptional credit discipline and repayment consistency.

7. What happens if my credit score is 0 or “NA/NH”?

This means you have no credit history yet — you haven’t taken any loans or used a credit card. Starting with a secured credit card can help build your score.

8. Can I go from a 600 to 800 credit score?

Yes, absolutely. By paying all EMIs on time, reducing credit card utilization below 30%, and maintaining accounts responsibly for 6–12 months, you can reach 800+.

9. What’s the average credit score in India?

Most active borrowers in India have a score between 700 and 750, which is considered good enough for general loan approvals and credit card eligibility.

10. Does having a 900 credit score make a difference from 800?

Both are excellent, but a 900 score may get you exclusive loan offers and the lowest possible interest rates it’s like having a perfect financial report card.

A strong credit score isn’t built overnight it’s the result of steady, responsible financial habits.

If you can consistently maintain a CIBIL score of 750 or higher, you’ll enjoy:

Take the first step today: Check your credit score online for free, review your CIBIL report, and start taking small, smart steps to build your financial future with confidence.

A contributor to the Finanjo blog, where I share insightful and easy-to-understand content focused on educating readers about finance. With a clear and approachable writing style, I simplify complex topics to make them more understandable.