PB Financial Account Aggregator Pvt. Ltd. is an RBI-licensed Account Aggregator based in New Delhi. Incorporated in 2019, it received its NBFC-AA license in March 2023 and is promoted by Punjab National Bank (PNB), one of India’s largest public sector banks. By extending PNB’s trusted legacy into digital data sharing, PB Financial aims to help individuals and businesses share financial information securely for faster credit and financial services.

This blog takes a closer look at PB Financial, explaining how it operates within the Account Aggregator ecosystem, the unique services it delivers, and the value it creates for consumers, small businesses, and financial institutions alike.

| Aspect | PB Financial Account Aggregator Overview |

|---|---|

| Parent Organization | Wholly-owned subsidiary of PB Fintech (the company behind PolicyBazaar & PaisaBazaar). |

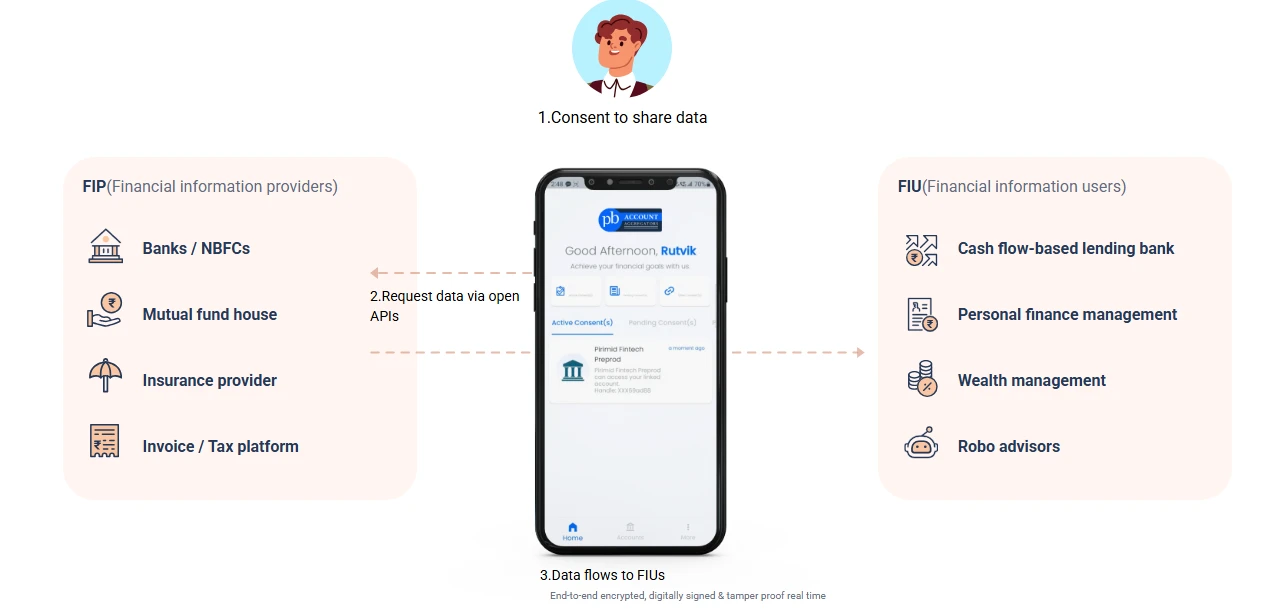

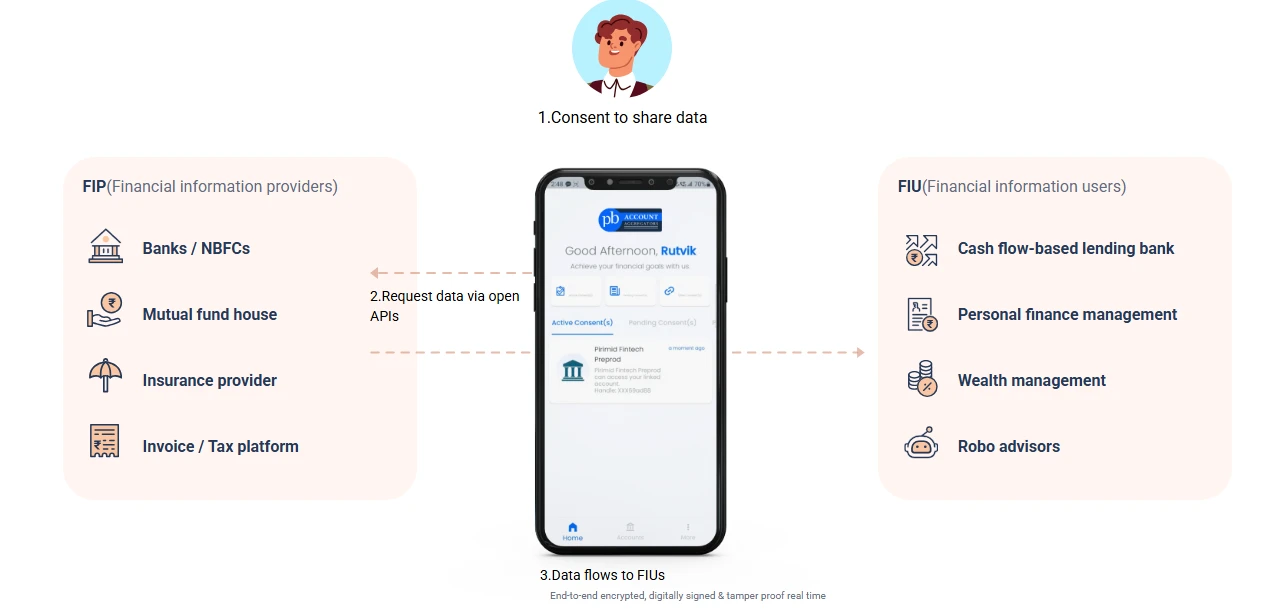

| Core Services | NBFC-Account Aggregator services: consent-based sharing of financial data between Financial Information Providers (FIPs) and Financial Information Users (FIUs) |

| Target Users | Banks, NBFCs, fintechs, insurance providers, mutual funds, investment platforms |

| Differentiator | Part of PB Fintech’s ecosystem (making use of its existing fintech, insurance & lending marketplace infrastructure) regulatory license as NBFC-AA |

| Use Cases | Enabling Paisabazaar & lending platforms to access customer financial data for decision-making, personal finance tools, wealth management & FIUs needing data flow simplifying onboarding and risk assessment through verified financial records. |

| Market Position | License received recently in October 2024, leveraging a strong parent fintech brand. |

An Account Aggregator is a framework introduced by the Reserve Bank of India (RBI). It allows users to share their financial data digitally and securely, with consent. Instead of uploading documents or statements, users can grant access through a simple and secure process. If you want to learn more Account Aggregator we have made a comprehensive guide.

PB Financial AA follows a consent-based process that is simple for users and secure for financial institutions. The main steps are:

Once you give consent, the FIP which holds your data will share it with the FIU that will offer you services like loans, insurance, or wealth management.

Customers can easily see and manage their financial profile on the PB Fintech AA network and enjoy complete control over their financial matters. There is no physical documentation, everything is paperless. Additionally, we cannot read, store or download your encrypted financial data.

Sourcs: PB FinTech

To understand how Account Aggregators work in a better way, let’s take an example. Suppose, you are a bank (FIU) and Mr. A applies for a personal loan with your bank. He needs to submit the following documents to get the loan:

These documents are needed to assess the financial health of Mr. A.

Upon receiving the request, the account aggregator in India collects and aggregates data from various accounts held by the FIPs and shares it with you. With access to Mr. A’s data quickly, it becomes easier to assess his eligibility for a loan. This reduces the turnaround time of your loan.

Note: For this to function, both the FIU and FIP should be registered with the AA.

PB Financial is part of the PB Fintech ecosystem and supports lending, credit services, and financial management across its platforms. Built on the AA framework, it enables secure, consent-based data sharing that helps lenders make faster and more accurate decisions. Some of the key use cases of PB Financial include:

By consolidating verified financial data, PB Financial helps new-to-credit customers improve approval chances, supports SMEs in accessing working capital, and powers financial tools like PBMoney for tracking balances and investments. While primarily serving PB Fintech platforms today, it streamlines credit journeys for both individuals and businesses, ensuring speed, accuracy, and control over data consent.

A key benefit of PB Financial is its integration with Paisabazaar, where it powers faster and more reliable loan journeys by providing lenders with verified financial data. For customers, this means fewer delays and less paperwork when applying for credit, even though they never interact with PB Financial directly.

Another strength is its role in supporting thin-file and new-to-credit borrowers. By enabling lenders to access income and transaction data through consent, it helps extend credit to individuals and businesses who lack traditional records.

PB Financial is not designed as a consumer-facing product. Instead, it works in the background and is used by businesses, lenders, and platforms that integrate it into their services.

| Factor | PB Financial AA | Finvu | Setu | CAMSFinServ | OneMoney | NADL (NeSL) |

|---|---|---|---|---|---|---|

| Network Coverage | Part of PB Fintech headquartered in New Delhi the numbers of FIPs live with is unavailable | Backed by VCs, headquartered in Pune they have 61 FIPs live with them | Backed by Pine Labs, headquartered in Bengaluru and they have 18 FIPs live with them | Part of MF registrar CAMS, headquartered in Chennai with 61 FIPs live. | Headquartered in Hyderabad with the highest number of FIPs live: 88. | Government-backed via NeSL, headquartered in Mumbai with 60 FIPs live. |

| Data Handling | Provides verified customer financial data (bank statements, credit history) to support credit assessment. | Focus on secure, consented sharing; emphasis on privacy and user control. | Tech-first approach with API-driven infrastructure they are optimized for smooth plug-and-play integrations. | Primarily compliance-focused, handling financial data with high security and oversight. | Provides encrypted real-time data with APIs and SDKs for decision insights. | Acts as a statutory repository of verified financial data with government oversight. |

| Role & Flexibility | Focused on lending enablement for the thin file users | Acts as an AA catering to fintechs and institutions, also have a in-house TSP | Developer-friendly AA designed for fintech adoption with highly flexible in integrations. Uses the network of Pine Labs for supplementary services | Natural fit for traditional institutions like banks, insurers, and asset managers. | Helps NBFCs with credit risk assessment using multiple data points. | Acts as a statutory repository of verified financial data with government oversight. |

| Differentiators | Distinct role by combining account aggregation with bureau-driven analytics; focuses on credit evaluation alongside data sharing. | Early VC support & really large number FIPs onboarded 61 | Blends regulatory compliance with fintech-first usability, Pine Labs’ backing also connects it to many merchants | Trusted financial record-keeper, compliance-first with decades of credibility. | First AA in India and with the highest number of FIPs onboarded: 88. | Government credibility ensures high adoption among institutions and statutory players. |

Another major concern with AAs is, are account aggregators safe. AAs act like your trusted assistants. With a strict regulatory framework and cutting-edge technology, they promise secure, efficient, and user-friendly solutions.

AAs use end-to-end encryption and user consent-based data sharing, ensuring that your financial information is safe and secure.

PB Financial remains one part of PB Fintech’s larger vision to build a diversified financial services platform, not just an Account Aggregator.

Ans: PB Financial Account Aggregator Pvt. Ltd. is an RBI-licensed Account Aggregator promoted by PB Fintech, the parent company of Paisabazaar and PolicyBazaar. It enables secure sharing of financial data with consent.

Ans: PB Financial was incorporated in 2019 and received its NBFC-AA license from the Reserve Bank of India in March 2023.

Ans: PB Financial is part of PB Fintech, the group that operates Paisabazaar and PolicyBazaar.

Ans: No, PB Financial is not a direct consumer-facing app. It works in the background and is mainly used by businesses, lenders, and platforms such as Paisabazaar that integrate it into their services.

Ans: By allowing lenders to access verified financial data with consent, PB Financial helps borrowers get faster loan approvals and improves access for those with little or no credit history.

Ans: Unlike general AAs that serve a wide variety of use cases, PB Financial is designed specifically to power lending journeys in the PB Fintech ecosystem, especially on Paisabazaar.

Ans: No, PB Financial does not store user data. It only acts as a secure channel to transfer information between financial institutions with user consent.

Ans: PB Financial plans to expand beyond lending support into areas like investment advisory, payments integration, and financial wellness tools as part of PB Fintech’s larger strategy.

Ans: Currently, PB Financial is primarily used within the PB Fintech ecosystem. As the network grows, it may support more external use cases in the future.

Ans: Yes, PB Financial follows the RBI’s Account Aggregator guidelines. All data transfers are encrypted and consent-driven, ensuring security and privacy.

PB Financial, part of PB Fintech’s push into regulated financial services, holds an RBI license and powers lending journeys on the Paisabazaar platform. Unlike many Account Aggregators that focus on individuals or wealth, PB Financial acts as a behind-the-scenes enabler, strengthening credit access and making loan approvals smoother.

Going forward, it is expected to expand beyond lending into investment advisory, financial wellness, and payments integration. While the AA is one piece of the puzzle, PB Fintech’s larger vision is to build multiple verticals and grow as a diversified financial services brand.

A contributor to the Finanjo blog, where I share insightful and easy-to-understand content focused on educating readers about finance. With a clear and approachable writing style, I simplify complex topics to make them more understandable.

PB Financial Account Aggregator Pvt. Ltd. is an RBI-licensed Account Aggregator based in New Delhi. Incorporated in 2019, it received its NBFC-AA license in March 2023 and is promoted by Punjab National Bank (PNB), one of India’s largest public sector banks. By extending PNB’s trusted legacy into digital data sharing, PB Financial aims to help individuals and businesses share financial information securely for faster credit and financial services.

This blog takes a closer look at PB Financial, explaining how it operates within the Account Aggregator ecosystem, the unique services it delivers, and the value it creates for consumers, small businesses, and financial institutions alike.

| Aspect | PB Financial Account Aggregator Overview |

|---|---|

| Parent Organization | Wholly-owned subsidiary of PB Fintech (the company behind PolicyBazaar & PaisaBazaar). |

| Core Services | NBFC-Account Aggregator services: consent-based sharing of financial data between Financial Information Providers (FIPs) and Financial Information Users (FIUs) |

| Target Users | Banks, NBFCs, fintechs, insurance providers, mutual funds, investment platforms |

| Differentiator | Part of PB Fintech’s ecosystem (making use of its existing fintech, insurance & lending marketplace infrastructure) regulatory license as NBFC-AA |

| Use Cases | Enabling Paisabazaar & lending platforms to access customer financial data for decision-making, personal finance tools, wealth management & FIUs needing data flow simplifying onboarding and risk assessment through verified financial records. |

| Market Position | License received recently in October 2024, leveraging a strong parent fintech brand. |

An Account Aggregator is a framework introduced by the Reserve Bank of India (RBI). It allows users to share their financial data digitally and securely, with consent. Instead of uploading documents or statements, users can grant access through a simple and secure process. If you want to learn more Account Aggregator we have made a comprehensive guide.

PB Financial AA follows a consent-based process that is simple for users and secure for financial institutions. The main steps are:

Once you give consent, the FIP which holds your data will share it with the FIU that will offer you services like loans, insurance, or wealth management.

Customers can easily see and manage their financial profile on the PB Fintech AA network and enjoy complete control over their financial matters. There is no physical documentation, everything is paperless. Additionally, we cannot read, store or download your encrypted financial data.

Sourcs: PB FinTech

To understand how Account Aggregators work in a better way, let’s take an example. Suppose, you are a bank (FIU) and Mr. A applies for a personal loan with your bank. He needs to submit the following documents to get the loan:

These documents are needed to assess the financial health of Mr. A.

Upon receiving the request, the account aggregator in India collects and aggregates data from various accounts held by the FIPs and shares it with you. With access to Mr. A’s data quickly, it becomes easier to assess his eligibility for a loan. This reduces the turnaround time of your loan.

Note: For this to function, both the FIU and FIP should be registered with the AA.

PB Financial is part of the PB Fintech ecosystem and supports lending, credit services, and financial management across its platforms. Built on the AA framework, it enables secure, consent-based data sharing that helps lenders make faster and more accurate decisions. Some of the key use cases of PB Financial include:

By consolidating verified financial data, PB Financial helps new-to-credit customers improve approval chances, supports SMEs in accessing working capital, and powers financial tools like PBMoney for tracking balances and investments. While primarily serving PB Fintech platforms today, it streamlines credit journeys for both individuals and businesses, ensuring speed, accuracy, and control over data consent.

A key benefit of PB Financial is its integration with Paisabazaar, where it powers faster and more reliable loan journeys by providing lenders with verified financial data. For customers, this means fewer delays and less paperwork when applying for credit, even though they never interact with PB Financial directly.

Another strength is its role in supporting thin-file and new-to-credit borrowers. By enabling lenders to access income and transaction data through consent, it helps extend credit to individuals and businesses who lack traditional records.

PB Financial is not designed as a consumer-facing product. Instead, it works in the background and is used by businesses, lenders, and platforms that integrate it into their services.

| Factor | PB Financial AA | Finvu | Setu | CAMSFinServ | OneMoney | NADL (NeSL) |

|---|---|---|---|---|---|---|

| Network Coverage | Part of PB Fintech headquartered in New Delhi the numbers of FIPs live with is unavailable | Backed by VCs, headquartered in Pune they have 61 FIPs live with them | Backed by Pine Labs, headquartered in Bengaluru and they have 18 FIPs live with them | Part of MF registrar CAMS, headquartered in Chennai with 61 FIPs live. | Headquartered in Hyderabad with the highest number of FIPs live: 88. | Government-backed via NeSL, headquartered in Mumbai with 60 FIPs live. |

| Data Handling | Provides verified customer financial data (bank statements, credit history) to support credit assessment. | Focus on secure, consented sharing; emphasis on privacy and user control. | Tech-first approach with API-driven infrastructure they are optimized for smooth plug-and-play integrations. | Primarily compliance-focused, handling financial data with high security and oversight. | Provides encrypted real-time data with APIs and SDKs for decision insights. | Acts as a statutory repository of verified financial data with government oversight. |

| Role & Flexibility | Focused on lending enablement for the thin file users | Acts as an AA catering to fintechs and institutions, also have a in-house TSP | Developer-friendly AA designed for fintech adoption with highly flexible in integrations. Uses the network of Pine Labs for supplementary services | Natural fit for traditional institutions like banks, insurers, and asset managers. | Helps NBFCs with credit risk assessment using multiple data points. | Acts as a statutory repository of verified financial data with government oversight. |

| Differentiators | Distinct role by combining account aggregation with bureau-driven analytics; focuses on credit evaluation alongside data sharing. | Early VC support & really large number FIPs onboarded 61 | Blends regulatory compliance with fintech-first usability, Pine Labs’ backing also connects it to many merchants | Trusted financial record-keeper, compliance-first with decades of credibility. | First AA in India and with the highest number of FIPs onboarded: 88. | Government credibility ensures high adoption among institutions and statutory players. |

Another major concern with AAs is, are account aggregators safe. AAs act like your trusted assistants. With a strict regulatory framework and cutting-edge technology, they promise secure, efficient, and user-friendly solutions.

AAs use end-to-end encryption and user consent-based data sharing, ensuring that your financial information is safe and secure.

PB Financial remains one part of PB Fintech’s larger vision to build a diversified financial services platform, not just an Account Aggregator.

Ans: PB Financial Account Aggregator Pvt. Ltd. is an RBI-licensed Account Aggregator promoted by PB Fintech, the parent company of Paisabazaar and PolicyBazaar. It enables secure sharing of financial data with consent.

Ans: PB Financial was incorporated in 2019 and received its NBFC-AA license from the Reserve Bank of India in March 2023.

Ans: PB Financial is part of PB Fintech, the group that operates Paisabazaar and PolicyBazaar.

Ans: No, PB Financial is not a direct consumer-facing app. It works in the background and is mainly used by businesses, lenders, and platforms such as Paisabazaar that integrate it into their services.

Ans: By allowing lenders to access verified financial data with consent, PB Financial helps borrowers get faster loan approvals and improves access for those with little or no credit history.

Ans: Unlike general AAs that serve a wide variety of use cases, PB Financial is designed specifically to power lending journeys in the PB Fintech ecosystem, especially on Paisabazaar.

Ans: No, PB Financial does not store user data. It only acts as a secure channel to transfer information between financial institutions with user consent.

Ans: PB Financial plans to expand beyond lending support into areas like investment advisory, payments integration, and financial wellness tools as part of PB Fintech’s larger strategy.

Ans: Currently, PB Financial is primarily used within the PB Fintech ecosystem. As the network grows, it may support more external use cases in the future.

Ans: Yes, PB Financial follows the RBI’s Account Aggregator guidelines. All data transfers are encrypted and consent-driven, ensuring security and privacy.

PB Financial, part of PB Fintech’s push into regulated financial services, holds an RBI license and powers lending journeys on the Paisabazaar platform. Unlike many Account Aggregators that focus on individuals or wealth, PB Financial acts as a behind-the-scenes enabler, strengthening credit access and making loan approvals smoother.

Going forward, it is expected to expand beyond lending into investment advisory, financial wellness, and payments integration. While the AA is one piece of the puzzle, PB Fintech’s larger vision is to build multiple verticals and grow as a diversified financial services brand.

A contributor to the Finanjo blog, where I share insightful and easy-to-understand content focused on educating readers about finance. With a clear and approachable writing style, I simplify complex topics to make them more understandable.